FII sold 7.6 K contract of Index Future worth 716 cores, Net OI has increased by 3.7 K contract 1.9 K Long contract were covered by FII and 5.7 K Shorts were added by FII. Net FII Long Short ratio at 0.89 so FII used fall to exit Long and enter short in Index Futures.

Nifty Bulls again failed to close above 50 SMA and Mercury Retrograde High, Now Again we have Bayer Rule coming on 02 Jan Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes.

First 15 mins HIgh and Low will guide for the day.

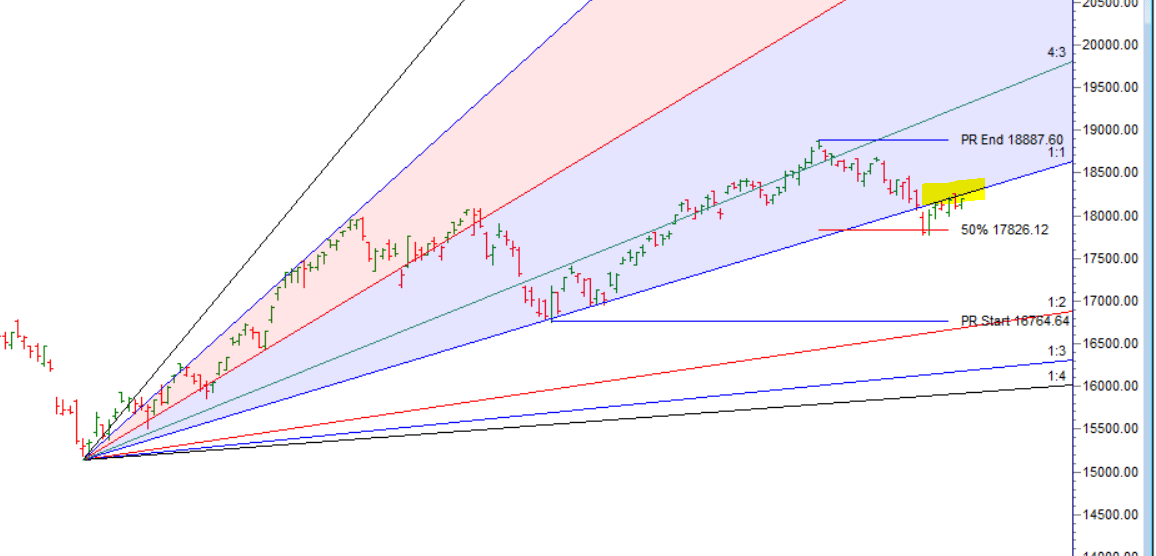

Bayers Rule will show its impact tommrow also we have important gann date today as shown below chart. We should see big move in next 2 trading session, Levels are clearly mentioned below.

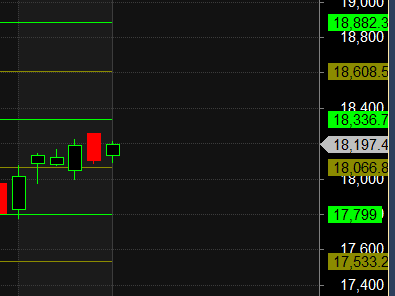

For Swing Traders Bulls need to move above 18225 for a move towards 18279/18343/18408/18472. Bears will get active below 18066 for a move towards 18022/17957/17893.

MAX Pain is at 18200 PCR at 1.05 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 22 lakh contracts was seen at 18300 strike, which will act as a crucial resistance level and Maximum PUT open interest of 22 lakh contracts was seen at 18100 strike, which will act as a crucial Support level

Retailers have bought 376 K CE contracts and 419 K CE contracts were shorted by them on Put Side Retailers bought 839 K PE contracts and 755 K PE shorted contracts were added by them suggesting having BEARISH outlook.

FII bought 35.8 K CE contracts and 35.3 K CE were shorted by them, On Put side FII’s bought 58.9 K PE and 70.6 K PE were shorted by them suggesting they have a turned to BULLISH Bias.

Nifty Jan Future Open Interest Volume is at 1.06 Cr with addition of 1.2 Lakh with increase in Cost of Carry suggesting Long positions were added today.

Nifty Rollover cost @18178 and Rollover % @72.5 Closed above it.

Till Nifty is above 18070 on closing basis price can rally till 18255/18403

FII’s sold 212 cores and DII’s bought 743 cores in cash segment.INR closed at 81.75

#NIFTY50 as per musical octave trading path can be 17799-18066-18336 take the side and ride the move !!

Your goal as a TRADER is preparedness, to trade with few surprises. To do so, you need to develop a dependable way to handle virtually every situation that may occur.

Positional Traders Trend Change Level is 18234 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18240 will act as a Intraday Trend Change Level.