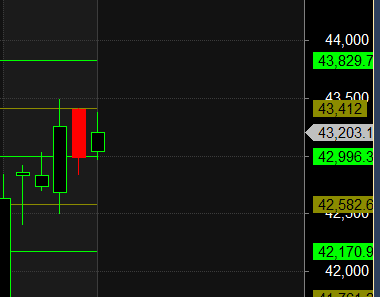

Bank Nifty Bulls again failed to close above 20 SMA and Mercury Retrograde High, Now Again we have Bayer Rule coming on 02 Jan Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes.

First 15 mins HIgh and Low will guide for the day.

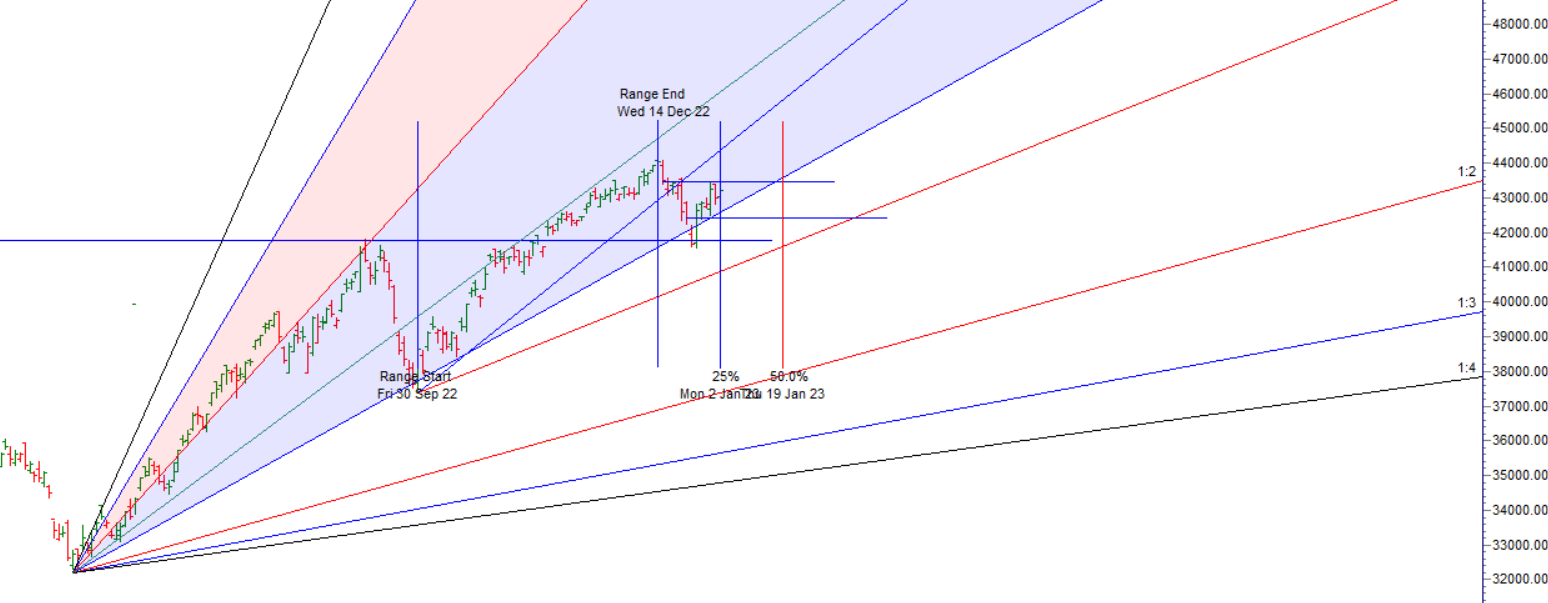

Bayers Rule will show its impact tommrow also we have important gann date today as shown below chart. We should see big move in next 2 trading session, Levels are clearly mentioned below.

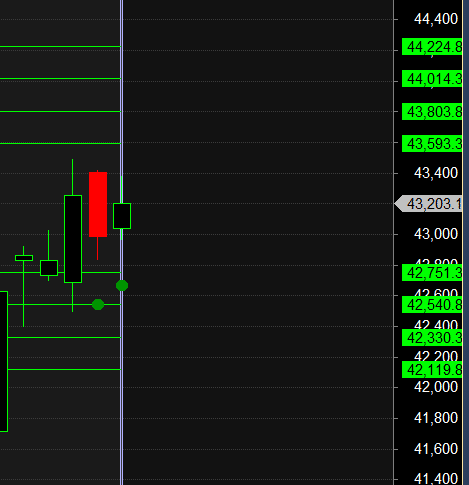

For Swing Traders Bulls need to move above 43400 for a move towards 43593/43803/44014. Bears will get active below 42950 for a move towards 42751/42540/42330.

Intraday time for reversal can be at 9:46/10:20/11:18/12:45/1:36/2:29 How to Find and Trade Intraday Reversal Times

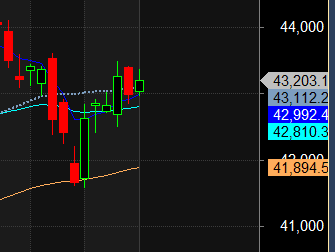

Bank Nifty Jan Future Open Interest Volume is at 21.8 lakh with addition of 0.18 Lakh contract , with decrease in Cost of Carry suggesting Long positions were added today.

Bank Nifty Rollover cost @42890 and Rollover % @80.4 Closed above it,

Bank Nifty Bulls now need to move above 43112 for move towards 44000.

Maximum Call open interest of 25 lakh contracts was seen at 43500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 25 Lakh contracts was seen at 43000 strike, which will act as a crucial Support level.

MAX Pain is at 43000 and PCR @1.05 . Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Your goal as a TRADER is preparedness, to trade with few surprises. To do so, you need to develop a dependable way to handle virtually every situation that may occur.

For Positional Traders Trend Change Level is 43244 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 43376 will act as a Intraday Trend Change Level.