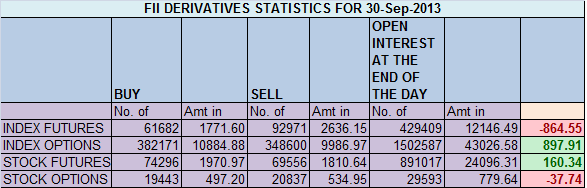

- FIIs sold 31289 contracts of Index Future (sold 25217 long contract and 6072 shorts were added ) worth 864 cores with net Open Interest decreasing by 19145 contracts.FII’s have shorted Index Futures again but in small quantity.CAD for Q1 widens to $21.8 billion, stands at 4.9% of GDP but numbers are better than market expectation.

- Nifty ended the September month on weak note, and also closed below its both 100 and 200 DMA. Nifty has taken the gap support and closed above it. Now the rising trendline will become the resistance on Nifty going forward.

- Nifty Future Oct Open Interest Volume is at 1.68 cores with liquidation of 10 lakhs in Open Interest,with fall in cost of carry.Nifty Future is still trading in premium of 56 points.

- Total Future & Option trading volume at 0.96 lakh with total contract traded at 2.7 lakh.PCR (Put to Call Ratio) at 0.84, signalling more calls are getting traded. Today’s fall was again based on low volumes both in cash and F&O. Fall we are seeing from past few days is based on less volume.

- 6000 Nifty CE is having highest OI at 33 lakhs with addition of 2.6 lakhs in OI, 5800 CE added 6.6 Lakhs will act as short term resistance.FII’s added 5.6 K in Call option and 14K CE were shorted. 5500-6000 CE added 1.5 lakh in OI.

- 5700 PE is having the highest OI of 38 lakhs, suggesting strong support of Nifty and 5800 PE liquidated 5.1 lakh of 9.1 lakh added yesterday suggesting 5800 PE writers panicked after todays fall but strong hands are still holding out.FII’s added huge 44.4 K in Put option and 2.2 K PE were shorted.5500-6000 PE added just 9.7K in OI so as per Option data todays fall was due to panic and it looks we can see a good bounce tomorrow, if 5720 is not broken.

- FIIs sold in Equity in tune of 519 cores ,and DII bought 89 cores in cash segment.INR closed at 62.6.

- Nifty Futures Trend Deciding level is 5810 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 5891 and BNF Trend Changer Level (Positional Traders) 10011 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 5755 Tgt 5790, 5810 , 5833 (Nifty Spot Levels)

Sell below 5720 Tgt 5700, 5680 and 5663 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863