- FIIs bought 14199 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 422 cores with net Open Interest increasing by 21579 contracts.FII has again started going long in Index Futures near our trend changer levels. The Big Trader’s Secret

- Nifty formed low of 5928 and high of 5977 but unable to cross our Weekly Trend Decide level@ 5978 as discussed in Weekly analysis Range contraction is going on in Nifty and next 2 days another big move is coming round the corner.

- Nifty Future May Open Interest Volume is at 1.91 cores with addition of 6.36 lakh in Open Interest with reduction in Cost of Carry of Nifty Future to showing traders are closing long position .

- Total Future & Option trading volume at 0.96 lakh with total contract traded at 1.53 lakh , PCR (Put to Call Ratio) has come near 1.07

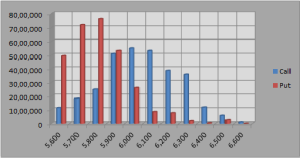

- 6000 Nifty CE is having highest OI at 55 lakhs with addition of 0.45 lakhs in OI ,6000 remains the wall of resistance.5900 CE is having OI at 51 lakhs and 6100 CE OI at 53 is next zone of resistance.5500-6200 CE liquidated 20.9 Lakhs in OI, so bulls are making their position strong.

- 5800 Put Option is having highest Open Interest of 76.1 lakhs with addition of 4.2 lakhs in OI ,5900 PE added 4.1 lakhs and net OI at 53.3 lakhs,suggesting call writing happening and base building happening at 5900 levels.5500-6200 CE added 13.1 Lakhs in OI

- FIIs bought in Equity in tune of 897 cores,and DII sold 541 cores in cash segment ,INR closed at 54.15 Live INR Chart for market hours and currency traders

- Nifty Futures Trend Deciding level is 5989 (For Intraday Traders).Nifty Trend Changer Level 5936 and Bank Nifty Trend Changer level 12516.

Buy above 5980 Tgt 6000,6020 and 6042(Nifty Spot Levels)

Sell below 5958 Tgt 5941,5930 and 5910(Nifty Spot Levels)

Nifty A/D charts is now available at http://

nifty-advance-decline-stocks.bl ogspot.in/ Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Sir,

I would like clarification on 3 points on todays blog.

1. OI volume data shows reduction in cost of carry of NF showing traders are closing long positions.

2. PCR is up compared to previous trading day showing more calls bought.

3. 6000, 5900 & 6100 CE having highest OI respectively showing bulls holding fort as mentioned by you.

Aren’t points 2&3 contradicting point 1 or am I missing the picture somewhere?

Please advise.

Regards,

Ashish Nevatia

Dear Sir,

I will clarify your doubts during our trading session. Need to give you few examples to make you understand the concept.

Rgds,

Bramesh