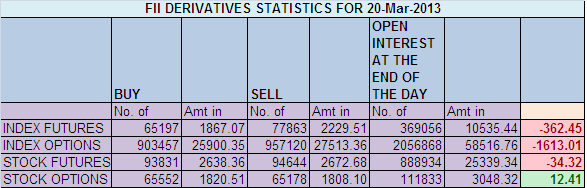

1. FIIs sold 12666 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 362 cores with net Open Interest decreasing by 7264 contracts. How Traders can Manage Stress in trading ?

2. As CNX Nifty Future was down by 36 points, with Open Interest in Index Futures decreasing by 7264 so FII started Booking profits in shorts in past few session.

3. NS closed at 5694 after making high of 5745 and low of 5682, Nifty continued with its downward moves,and closed below 5700. Nifty is very near to its last support of 5664 which if gets broken Nifty will fall in a panic mode and should tocuh its 200 DMA@5611. Hourly charts are in oversold nature and a bounce back is expected in next 2 trading sessions. Here i would mention please do not concentrate of finding bottom of Nifty and go long in market which is just a waste of time,energy and money. Let the market give us the signal than its reversing till than stay with trend.

4. Resistance for Nifty has come up to 5722 and 5745 which needs to be watched closely ,Support now exists at 5684 and 5664.

5. Nifty Future March Open Interest Volume is at 1.50 cores with liquidation of 9.3 lakh in Open Interest with huge rise in Cost of Carry of Nifty Future to showing traders are booking profit in short positions in Index Futures.

6. Total Future & Option trading volume at 1.94 lakh Cores with total contract traded 2.65 lakh , PCR (Put to Call Ratio) at 0.95 so smart money is exiting Puts which is giving indication we might see a bottom soon and VIX at 16.66

7. 6000 Nifty CE is having highest OI at 99.4 Lakh with liquidation of 0.4 Lakhs, 5900 CE added 1.25 lakhs having OI of 82.2 lakhs ,5800 CE also added 10.9 lakhs in OI and 5700 CE added 19.9 lakhs in OI, suggesting traders are writing 5700 CE aggressively, recipe for a bounce back when boat get tilted on one side heavily .5500-6200 Call Options added huge 31.4 lakhs in OI. FII sold 1600 cores in Nifty Options today.

8. 5700 Put Option is having highest Open Interest of 83 lakhs with liquidation of 1.6 lakhs in OI 5700 is wall of Support is under danger even nifty closed below 5700 put writers have not panicked and holding on to their positions , 5800 PE liquidated 21.2 lakhs with OI at 45.7 lakhs resistance for any upswing we will see and 5900 PE liquidated 4.9 lakhs in OI with net OI at 29.4 lakhs suggesting smart money liquidating position. 5500-6200 Put Options liquidated 21.6 lakhs in OI.

9. FIIs sold in Equity in tune of 256 cores,and DII sold 357 cores in cash segment,INR closed at 54.42 Live INR Chart for market hours and currency traders

10. Nifty Futures Trend Deciding level is 5709(For Intraday Traders), Trend Changer at 5839 NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 11841.As per trend changer level shorts are still a hold with part profit booking done.Traders trading on these levels in both Nifty Futures and Bank Nifty Futures would have made good profit.

Buy above 5707 Tgt 5720, 5732,5746

Sell below 5684 Tgt 5664,5638 and 5610(Nifty Spot Levels)

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863