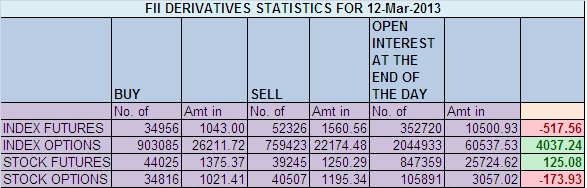

1. FIIs sold 17370 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 517 cores with net Open Interest decreasing by 11650 contracts. Painful Truths About Trading

2. As CNX Nifty Future was down by 20 points, with Open Interest in Index Futures increasing by 11650 so FII have initiated shorts in today’s session.

3. NS closed at 5914 after making high of 5952 and low of 5893 after IIP data and Inflation data both came more than expected the market, So good IIP data got nullified by Bad Inflation data 🙂 . Nifty has reacted sharply from Weekly Trend Deciding Level of 5971 yesterday and also closed below 50 SMA@5943 for 5 time in a row from Feb 8. As discussed yesterday in option analysis Nifty is Buy near 5900 and we were able to catch almost 40 points using our Initial NF range on Facebook page and Option analysis.

4. Resistance for Nifty has come up to 5943 and 5971 which needs to be watched closely ,Support now exists at 5895 and 5863.Trend is Buy on Dips till 5865 is not broken on closing basis.

5. Nifty Future March Open Interest Volume is at 1.60 cores with liquidation of 5.74 lakh in Open Interest with rise in Cost of Carry of Nifty Future to showing traders have liquidated short position in Index Futures.

6. Total Future & Option trading volume at 1.52 lakh Cores with total contract traded 2.12lakh , PCR (Put to Call Ratio) at 1.35 and VIX at 15.13.

7. 6000 Nifty CE is having highest OI at 67.2 Lakh with addition of 7.5 Lakhs, 5900 CE added 3.2 lakhs having OI of 54.9 lakhs .6200 CE added 5 lakh in OI with net premium at rs 5 needs to be watched closely as its speculative money or smart money .5600-6200 Call Options added 10.9 lakhs in OI.

8. 5700 Put Option is having highest Open Interest of 1.20 cores with addition of 10.1 lakhs in OI 5700 is wall of Support , 5800 PE also added 6.2 lakhs with OI at 1.06 cores and 5900 PE liquidated 2.7 lakhs in OI with net OI at 72 lakhs suggesting Bullsgot scared and liquidated position once nifty dipped below 5900, 5500-5600 PE both combined added 41 lakh in OI and FII has bought 4037 cores in options suggesting covering of shorts as premium of 5600 PE is down from rs 50 to Rs 5 .5600-6200 Put Options added 43 lakhs in OI.

9. FIIs bought in Equity in tune of 733 cores,and DII sold 877 cores in cash segment,INR closed at 54.08 Live INR Chart for market hours and currency traders

10. Nifty Futures Trend Deciding level is 5954(For Intraday Traders), Trend Changer at 5837 NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 11900.

Buy above 5920 Tgt 5946, 5971,5988

Sell below 5900 Tgt 5883,5863and 5850 (Nifty Spot Levels)

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed

fii data is available on nse site mr.anil but the analysis is only available at http://www.brameshtechanalysis.com

Hello sir,

I am big fan of your site. I wanted to know from where do you get these FII DEREVATIVES STATSTICS Daily

if feb month closing is higher that jan month in a calendar year..that particular rest of the year will be bullish..is that historically true ? kindly share your view sir..

Dear Sir,It is understood that in serial No.5 the Ist line Nify future Feb open interast volume I feel that the month it is March instead of Feb. Am I wrong. Please excuse me for writing this If I am wrong.

Thank,u, I am your admirer.

Dear Venkatesh sir

Mistake corrected its March

Rgds,

Bramesh

how then open interest for FII is increasing when FII are exiting is my basic question.

For FII, with option net buy figure Open INterest is increasing..that is my point…

nevertheless I read your blog daily and the content is fine although you have a bullish tendency always…

Dear sir,

If system reamins in Buy we have Bullish views and most of Feb we were short. Its how you see the analysis..

OI is increasing coz they are sellers in PE and Buyers in CE.

Rgds,

Bramesh

Bramesh,

When you say 5600, 5700 and 5800 put are short covering by FII, then logically the Open interest should be decreased.

But here the OI is increasing. I guess they are buying PUT options and expect a crash next week

Dear Mangoman,

Well FII might be exiting and HNI retailers can be buying. Its the same scenario which happened in Aug 2012 where daily rise in OI of calls were seen and traders were expecting a big rally but market was jst rangebound

Rgds,

Bramesh