Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bearish approach as they displayed a preference for SHORT positions. On a net basis, FIIs went SHORT 284 contracts worth 26 crores, resulting in an increase of 2408 contracts in the Net Open Interest. Additionally, they sold 2162 long contracts and covered 1557 short contracts, indicating a strategy of covering long positions and covering of short positions. Till Date FII’s are covered 3133747 85 Long and added 3736 SHORT.

Today we have important aspect forming which are as follows

- Mars Opposition Neptune

- Venus Square Jupiter

- Jupiter Opposition Moon

- Sun moving to Virgo

- ALso 22 Aug is important Gann Date

- Bank Nifty completed 360 Trading Days from 08 March 2022 Low

With Both Gann and Astro date confluncing again we can see big move, For INtraday traders First 15 mins HIgh and low will guide for the day, Swing traders levels are mentioned as below.

Nifty has formed an NR21 days when gann and astro cycle are confluencing and be prepared for big move as explained in below video with Both Mercury which is Retrograde and Sun Changing Sign.

The NR21 pattern, as the name suggests, refers to a trading situation where the range of price movement over a specific period is exceptionally narrow. Specifically, the range should be the smallest within the past 21 trading sessions.

The significance of the number 21 lies in its representation of a trading month, considering the typical number of trading days. Traders use this period to identify the tightest range within which price has moved.

The NR21 pattern signifies a state of market compression, where volatility is notably reduced. This reduction in price range is often indicative of a period of indecision among traders.

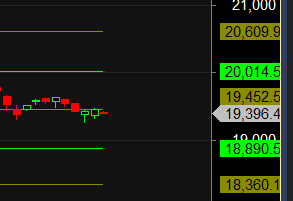

Nifty Trade Plan Bulls will get active above 19444 for a move towards 19505/19575/19645. Bears will get active below 19381 for a move towards 19319/19256

Traders may watch out for potential intraday reversals at 9:21,11:49,1:00,1:55,2:21 How to Find and Trade Intraday Reversal Times

Nifty July Futures Open Interest Volume stood at 1.0 lakh, witnessing a liquidation of 1.6 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of SHORT positions today.

Nifty Advance Decline Ratio at 28:22 and Nifty Rollover Cost is @19860 and Rollover is at 73.9 %.

Nifty has bounced from 50 SMA @19291 ,Once we close below 19290 heading towards 19108/19000

Nifty options chain shows that the maximum pain point is at 19350 and the put-call ratio (PCR) is at 0.91 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19500 strike, followed by 19600 strikes. On the put side, the highest OI is at the 19300 strike, followed by 19200 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19200-19500 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 495 crores, while Domestic Institutional Investors (DII) bought 533 crores.

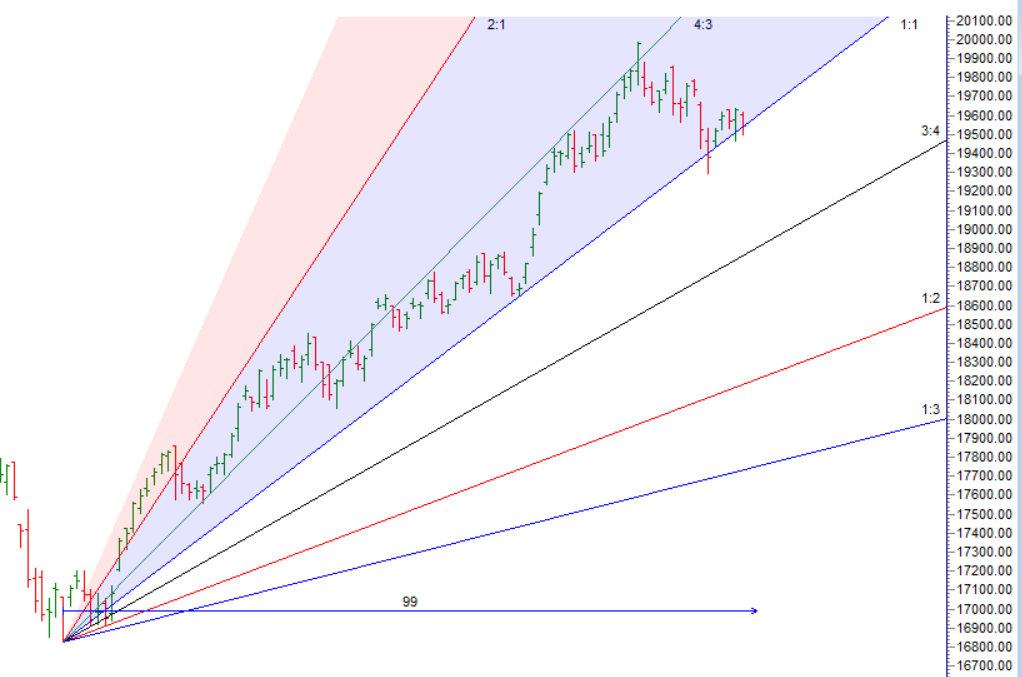

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price has closed below 19452 3 days in a row

One of the most important attributes of a professional trader is the willingness to accept full responsibility for one’s actions. One can never improve if every mistake is the broker’s, or the fault of the data vendor, or the software.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19566 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19402 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 19425 Tgt 19450, 19485 and 19525 (Nifty Spot Levels)

Sell Below 19360 Tgt 19320, 19285 and 19240 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.