Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Bank Nifty Index Futures market by buying 3055 contracts worth 339 crores, resulting in a decrease of 3573 contracts in the Net Open Interest.

As Discussed in Last Analysis

Venus Ingress combined with Price Pattern can lead to big move. Bank Nifty has formed an NR21 pattern.

Bank Nifty continue to be in Buy on Dips mode, whole day remain down but showed a smart recovery by end of the day forming a perfect DOJI, Bank Nifty is waiting for RBI policy to provide fresh trigger. Mid and Small Caps are shhowing Decent move with many small caps hitting 20% UC, traction has shifted from Index to Small and Mid Cap Stocks.

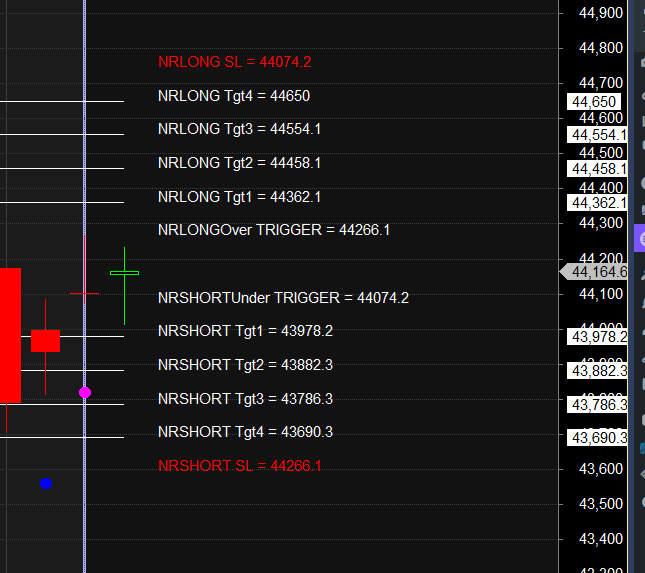

Trade Plan as per Narrow Range 21 pattern and Venus Ingres Bulls will get active above 44266 for a move towards 44362/44458/44554/44650. Bears will get active below 44074 for a move towards 43978/43882/43786/43690.

Traders may watch out for potential intraday reversals at 9:15,9:47,11:01,1:29 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 23 lakh, liquidation of 0.03 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 6:6 and Bank Nifty Rollover Cost is @43908 and Rollover is at 72.2%

Major Support for Bank Nifty us at 43904 which is 20 SMA

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 40789-41967-43216 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is has broken 43216 Heading towards 44464 — 44464 done

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44000 strike, followed by the 44500 strike. On the put side, the 43500 strike has the highest OI, followed by the 44000 strike. This indicates that market participants anticipate Bank Nifty to stay within the 44000-44500 range.

The Bank Nifty options chain shows that the maximum pain point is at 44100 and the put-call ratio (PCR) is at 1.11 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Don’t overtrade. It’s tempting to trade frequently, but this can lead to losses. It’s better to trade less and focus on making high-quality trades.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 44147. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 44335, Which Acts As An Intraday Trend Change Level.