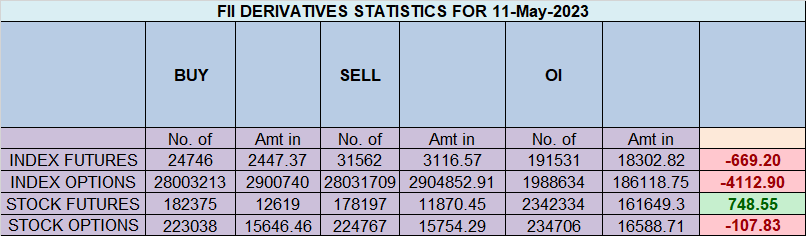

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 4491 contracts worth 411 crores, resulting in a increase of 6245 contracts in the Net Open Interest. FIIs bought 1000 long contracts and added 7816 short contracts, indicating a preference for Buying/SHorting positions .With a Net FII Long Short ratio of 0.89 , FIIs utilized the market fall to enter long positions and enter short positions in Index Futures.

We got a dip today in Nifty which was again bought into, 18200 is very important level now. When trend is strong first 2 dips are bought into but the third dip genreally break the support and lead to bigger fall for trend change as per Gann Studies. For any bearish trend Nifty need to move below 18194 which is Gann Monthly Trend Change Level. Nifty has formed Long Legged Doji similar to 05-Dec.

Nifty made an opening high around 18390 and remained range-bound throughout the day. This weekend, we have Mercury’s ingress and Mercury retrograde getting over, along with an important Jupiter-Uranus aspect. Additionally, we will receive the Karnataka election results on the weekend, so we may open with a gap on Monday. If you are carrying an overnight position, it’s advisable to hedge your position. With low volatlity market has become rangebound in intraday but with Mercury and JUpiter astro events we expect volatlity to increase in next week.

As per Multiple Astro Date Yesterday below is the Plan based on Intraday Ratio Indicator

Bulls need to move above 18353 for a move towards 18400/18463/18518. Bears will get active below 18219 for a move towards 18172/18109/18054/18010.

Price continue to trade within the range from past 2 trading sessions.

Traders may watch out for potential intraday reversals at 9:15,10:19,12:12,12:49,2:05 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.16 lakh, witnessing a addition of 5.5 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 27:23 and Nifty Rollover Cost is @17885 and Rollover is at 58.7 %.

Nifty options chain shows that the maximum pain point is at 18300 and the put-call ratio (PCR) is at 0.91 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18300 strike, followed by 18400 strikes. On the put side, the highest OI is at the 18100 strike, followed by 18000 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18200-18400 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 837 crores, while Domestic Institutional Investors (DII) sold 200 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has come near 18272

Neurons and synapses in our brain are real destiny and with proper learning and revision, performance is accelerated.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18205 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18355, Which Acts As An Intraday Trend Change Level.