FII bought 5.7 K contract of Index Future worth 475 cores, Net OI has decreased by 2.6 K contract 1.4 K Long contract were added by FII and 4.2 K Shorts were covered by FII. Net FII Long Short ratio at 1.37 so FII used fall to enter Long and exit short in Index Futures.

IT Stocks saw a big rally today also combined with Lunar cycle as discussed below Bulls have upper hand, We will open 100+ point gap up tommrow and Reliance at crucial level can prople nifty towards 18300 zone. Outer plannet bring long term trend change it can help nifty breaking out of the range lead to move of 400-500 points till Budget.

Again a side ways day price unable to sustain above 18200, Price Last expiry close was 18191 so we can see close around 1819 to form an expiry doji. Jupiter 40 Uranus both outer plannet so Bank Nifty should see firework. IT has already joined the party with bank support price can hit 50 SMA.

During “intraday trading” , especially in a sideways market, you pick up points and a SL should be kept well away from the day’s low & Highs as markets often breach these extremes and continue to trade the ranges.

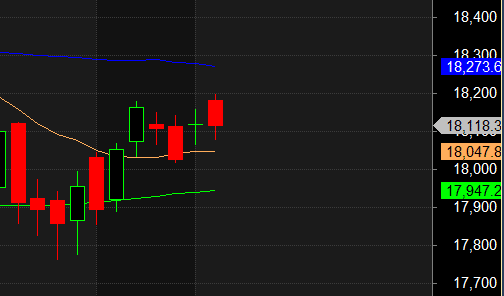

Nifty Bulls need to move above 18155 for a move towards 18200/18246/18292/18338

Nifty Bears need to move below 18060 for a move towards 18018/17972/17926/17880

NIfty has finally closed above 20 SMA now price can target 18256-18288 zone where 50 SMA lies.

MAX Pain is at 18100 PCR at 1.03 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 87 lakh contracts was seen at 18300 strike, which will act as a crucial resistance level and Maximum PUT open interest of 60 lakh contracts was seen at 18100 strike, which will act as a crucial Support level

Nifty Feb Future Open Interest Volume is at 0.64 Cr with addition of 19 Lakh with increase in Cost of Carry suggesting Long positions were closed today.

Nifty Rollover cost @18178 and Rollover % @72.5 Closed below it.

Retailers have bought 388 K CE contracts and 383 K CE contracts were shorted by them on Put Side Retailers sold 348 K PE contracts and 193 K shorted PE contracts were covered by them suggesting having Bearish outlook.

FII bought 52.9 K CE contracts and 26.5 K CE were shorted by them, On Put side FII’s bought 12.5 K PE and 55.7 K shorted PE were covered by them suggesting they have a turned to neutral Bias.

FII’s sold 760 cores and DII’s bought 1444 cores in cash segment.INR closed at 81.60

#NIFTY50 as per musical octave trading path can be 17799-18066-18336 take the side and ride the move !!

Review the last week’s entries in your trading journal. Count the number of positive, encouraging phrases in your writings and the number of negative, critical ones. If the ratio of positive to negative messages is less than one, you know you aren’t sustaining a healthy relationship with your inner coach. And if you’re not keeping a journal, your coach is silent. What sort of relationship is that?

Positional Traders Trend Change Level is 18102 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18154 will act as a Intraday Trend Change Level.