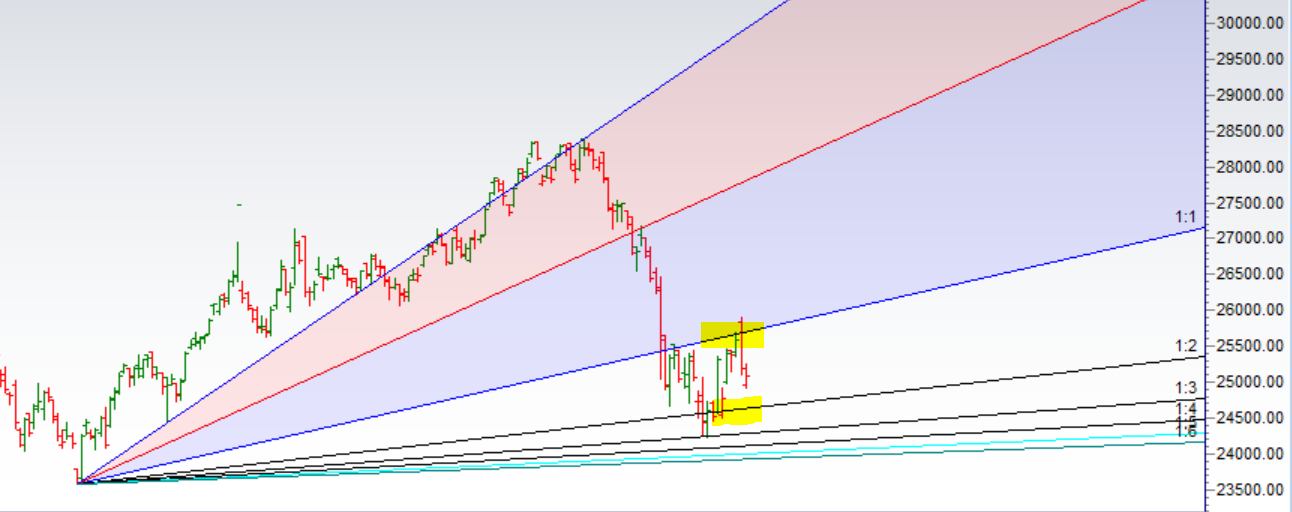

- As Discussed in Last Analysis Now Bulls need to close above 25225 for a move back 25344/25488/25632/25776. Bearish below 25050 for a move back to 24912/24768/24624/24500. Bank Nifty opened with gap down made low of Now Bears need to break 24920 for fresh down move to happen towards 24784/24656/24500. Bullish above 25200 for a move back to 25344/25488. Important intraday time for reversal can be at 11:27/2:22. DivA Software for Fundamental Analysis for All Companies of BSE and NSE

- Bank Nifty Oct Future Open Interest Volume is at 14.4 lakh with addition of 1.9 Lakh, with decrease in Cost of Carry suggesting short positions were closed today. Bank nifty Rollover cost @25319 closed above it.

- 25500 CE is having highest OI @9.2 Lakh resistance at 25500 followed 25800. 24000-27000 CE added 15.3 Lakh in OI so bears added in range 25500-26000 CE.

- 24500 PE is having highest OI @7.5 Lakh, strong support at 24800 followed by 24500.24000-26000 PE added 1 lakh OI so bulls making support at 24800-25000 range.

- Bank Nifty Futures Trend Deciding level is 25080 For Intraday Traders). BNF Trend Changer Level (Positional Traders) 25107 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 25125 Tgt 25225,25320 and 25450 (Bank Nifty Spot Levels)

Sell below 25000 Tgt 24920,24784 and 24600 (Bank Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Ramesh Sir can u briefly explain bank nifty max pain strategy. When and where to sell options. Thanks for providing lot of valuable technical and fundamental information in this site.