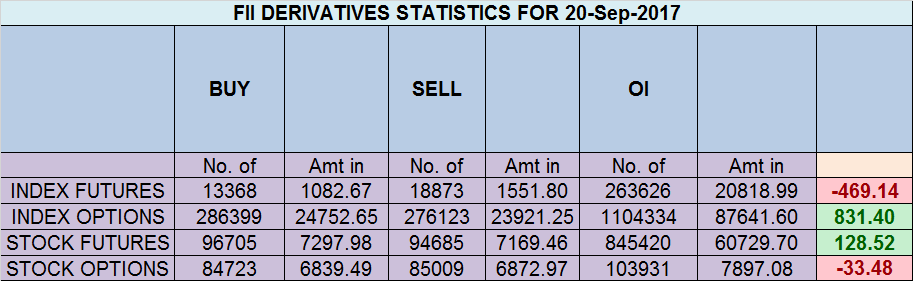

- FII’s sold 5 K contract of Index Future worth 469 cores ,2.6 K Long contract were added by FII’s and 8.1 K Short contracts were added by FII’s. Net Open Interest increased by 10.7 K contract, so fall in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 1.14. Unlock your Trading Success

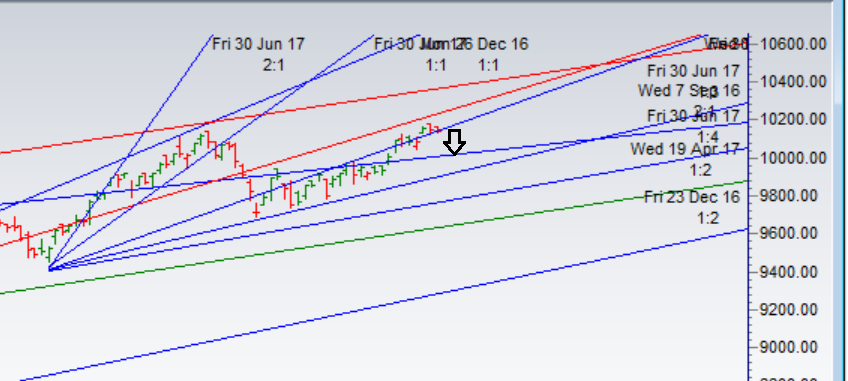

- As discussed in last analysis Another failed attempt to close above 10171, but still able to hold 10100 level. Day of consolidation after new high, not change in structure of market as we are holding the gann angle as shown in below chart. Another failed attempt to cross 10171, 2 small days of consolidation and again we protected gann angle again, expect a good move in nifty in coming 2 trading sessions. Bullish above 10171 for a move towards 10236/10300. Bearish below 10100 for a move towards 10030/9970. Bank Nifty ready for big move,EOD Analysis

- Nifty September Future Open Interest Volume is at 2.08 core with addition of 3.7 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @9910 Closed above it and rallied 250 points.

- Total Future & Option trading volume at 4.31 Lakh core with total contract traded at 0.52 lakh , PCR @0.98

- 10200 CE is having Highest OI at 56 Lakh, resistance at 10200 followed by 10100 .9900-10500 CE liquidated 3.4 Lakh in OI so bears covered major position in range of 10100-10200 CE. FII bought 1.8 K CE and 1.4 K CE were shorted by them. Retail bought 45 K CE and 30.9 K CE were shorted by them

- 10000 PE OI@56.9 lakhs having the highest OI strong support at 10000 followed by 9900. 9900-10500 PE liquidated 3.3 Lakh in OI so bulls covered position in 9900-10300 PE,making strong base at 9900. FII bought 13 K PE and 3.1 K PE were shorted by them. Retail bought 5.6 K PE and 16.8 K PE were shorted by them

- FII’s sold 1185 cores and DII’s bought 946 cores in cash segment.INR closed at 64.27

- Nifty Futures Trend Deciding level is 10167 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10036. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10172 Tgt 10192,10213 and 10240 (Nifty Spot Levels)

Sell below 10130 Tgt 10110,10090 and 10060 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh