- FII’s bought 0.8 K contract of Index Future worth 40 cores ,2.8 K Long contract were added by FII’s and 2 K short contracts were added by FII’s. Net Open Interest increased by 4.8 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. How to create new habits?

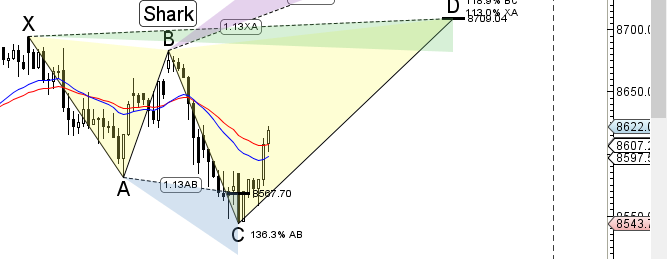

- As discussed in Yesterday Analysis Bulls above 8723 can see move till 8851/8900, bears below 8577 can see move till 8520/8484. Its been 24 days we have traded in range of 204 points 8517-8721,Low made today was 8547 and close below near our important gann level of 8577 , suggesting bears are having upper hand after long time. Nifty can fall below 8520/8484. Nifty made low of 8544 and bounced back again above 8577. Situation like this only cause trader maximum loss as most of traders are stuck with bearish bias and with change in market trend unable to adjust /reverse position and market sees an impulsive move. As I always say traders should be like a chameleon change colors soon as market is changing color. Nifty is forming the last leg of shark pattern holding today’s low we can move towards 8710 again to complete the pattern. Bank Nifty bears unable to capitalize on fall below 19158,EOD Analysis

- Nifty Sep Future Open Interest Volume is at 2.77 core highest in last 6 years with addition of 3.7 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @8686, closed below it.

- Total Future & Option trading volume was at 2.23 Lakh core with total contract traded at 1.3 lakh , PCR @1.16 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 40 lakh, resistance at 9000 .8500/9000 CE added 15 lakh so resistance formation in 8800-8900 zone .FII bought 9.2 K CE longs and 6.9 K CE were shorted by them .Retail bought 28.2 K CE contracts and 38.6 K shorted CE were covered by them.

- 8500 PE OI@59 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 24 Lakh in OI so bulls making strong base near 8550-8500 zone .FII bought 13.3 K PE longs and 13.9 K PE were shorted by them .Retail bought 54.4 K PE contracts and 34.7 K PE were shorted by them.

- FII’s bought 286 cores in Equity and DII’s bought 17 cores in cash segment.INR closed at 67.17

- Nifty Futures Trend Deciding level is 8617 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8643 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8640 Tgt 8669,8700 and 8722 (Nifty Spot Levels)

Sell below 8585 Tgt 8560,8542 and 8512 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

NIFTY PAUSED@7850 ??

SORRY NIFTY@8750

Sir,

Highest OI, High PCR suggest any trending move on downside

Dear Sir,

What is time frame you used above mentioned chart.

Excellent observation of inexperienced trader’s psychology. Sir, the community should remain indebted to u.

Is it a bearish Shark formation…..if yes wats the tgt levels

clearly mentioned check the image..