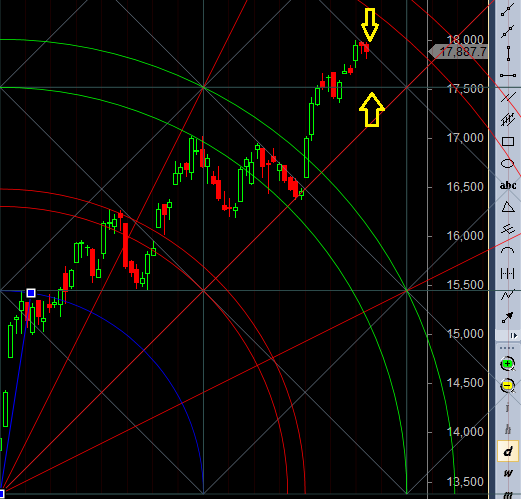

- As discussed in last analysis Now next bullish move on close above 18030 for target of 18500/18758. Bearish only on close below 17500. High made today was 17986 near the gann horizontal line and low made was 17801, Bullish only on close above 18000 and bearish below 17620. So again we are in no trade zone till we do not break 17620 on downside or 18030 on upside. Billionaire Traders and Hedge Fund Manager

- Bank Nifty June Future Open Interest Volume is at 17.97 lakh with liquidation of 0.17 lakh, with decrease in Cost of Carry suggesting short positions were added today. Bank nifty Rollover cost is coming at 16995 closed above it. Do you know your Risk of Ruin in trading ?

- 18000 CE is having highest OI @5.4 Lakh resistance formation @18000. 17000-19000 CE saw 0.29 lakh addition in OI so bears added in 18000 CE.

- 17000 PE is having highest OI @6.1 Lakh, strong support at 17000 followed by 16500, Bulls added 0.17 Lakh in OI in 17000-19000 PE as close above 17670.

- Bank Nifty Futures Trend Deciding level is 17851 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 17595.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 17900 Tgt 17982,18080 and 18166(Bank Nifty Spot Levels)

Sell below 17780 Tgt 17700,17620 and 17500 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Click Here to Join me on Twitter

Sir,

Is intraday breaking of 18030 is sufficient go long liewise is intraday breaking on downside of 17620 to go short??