SBIN

Positional/Swing Traders can use the below mentioned levels

Close above 212 Tgt 220/225

Intraday Traders can use the below mentioned levels

Buy above 210 Tgt 211.5,213.8 and 215 SL 208.5

Sell below 207 Tgt 206,203.8 and 201 SL 208.5

Maruti

Positional/Swing Traders can use the below mentioned levels

Holding 4181 Tgt 4270/4325

Intraday Traders can use the below mentioned levels

Buy above 4250 Tgt 4270,4294 and 4325 SL 4225

Sell below 4180 Tgt 4165,4130 and 4095 SL 4200

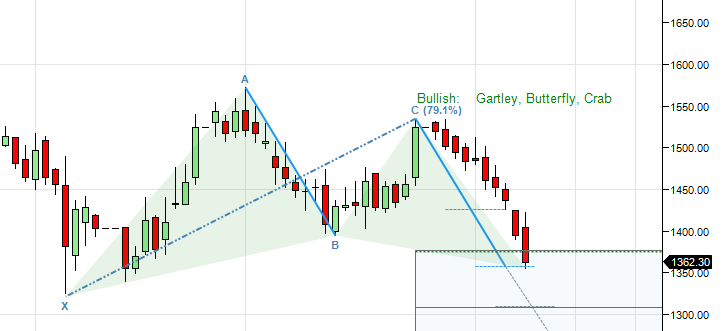

Jubilant Food

Positional/Swing Traders can use the below mentioned levels

Close above 1364 Tgt 1453

Intraday Traders can use the below mentioned levels

Buy above 1366 Tgt 1380,1400 and 1422 SL 1356

Sell below 1350 Tgt 1339,1315 and 1280 SL 1360

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for December Month, Intraday Profit of 2.61 Lakh and Positional Profit of 4.48 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

SIMPLE & CLEAR CUT ANALYSIS

Performance is updated daily or once in a month?

THANKS BRAMESHJI

its updated on daily basis.

Brameshji, since SBI closed at 204.3. What can we infer on it?

We trade on levels, No level = N0 trade