- FII’s bought 12.4 K contract of Index Future worth 756 cores ,7.5 K Long contract were added by FII’s and 4.9 K short contracts were liquidated by FII’s. Net Open Interest increased by 2.6 K contract, so today’s rise/fall in market was used by FII’s to enter long and exit shorts in Index futures. What’s Your Trading Brain Type?

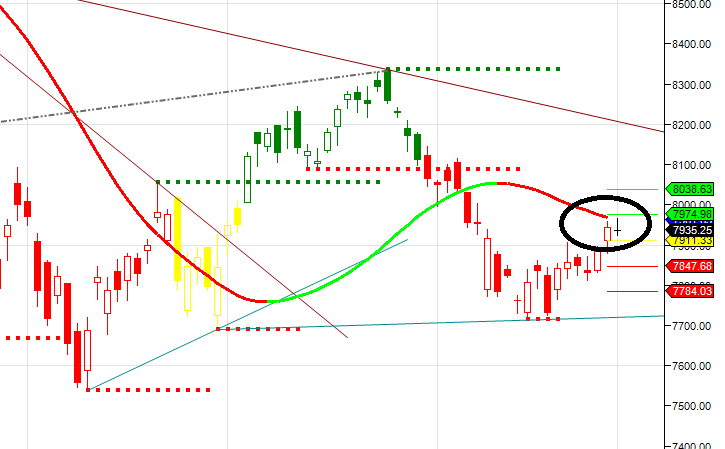

- Nifty formed DOJI pattern after 2 days of rally consolidating the gains. Nifty is nearing trend change as shown in gann swing chart, Closing above 7994 will lead to trend change on upside, Till 7906 is held we can move towards 7994/8051/8116, Support is at 7906/7851. Bank Nifty entering RBI Event with Bullish bias,EOD Analysis

- Nifty December Future Open Interest Volume is at 1.92 core with addition of 7.6 Lakh with increase in CoC suggesting long position were added today. Nifty closing above rollover cost 7896.

- Total Future & Option trading volume was at 1.23 Lakh core with total contract traded at 1.08 lakh , PCR @0.87.

- 8500 CE OI at 37.3 lakh , wall of resistance @ 8500 .7800/8500 CE added 13.2 lakh in OI as bears added position at higher level most of addition was seen in 8300/8500 CE.FII bought 8.7 K CE longs and 9.2 K CE were shorted by them.Retail bought 16.7 K CE contracts and 12.5 K CE were shorted were by them.

- 7500 PE OI@ 47.9 lakhs strong base @ 7500. 7500/8000 PE added 10 lakh so bulls added postion is 7700/7800 PE forming base at higher levels .FII bought 13.1 K PE longs and 2.1 K PE were shorted by them .Retail bought 14.6 K PE contracts and 18.5 K PE were shorted by them.

- FII’s sold 1043 cores in Equity and DII’s bought 602 cores in cash segment.INR closed at 66.66.

- Nifty Futures Trend Deciding level is 7976 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7949 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7960 Tgt 7985,8003 and 8051 (Nifty Spot Levels)

Sell below 7915 Tgt 7898,7875 and 7850 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh