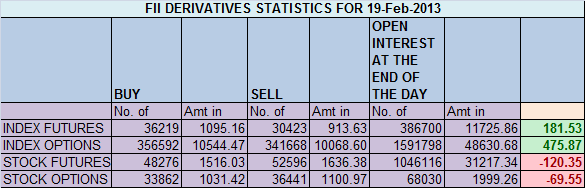

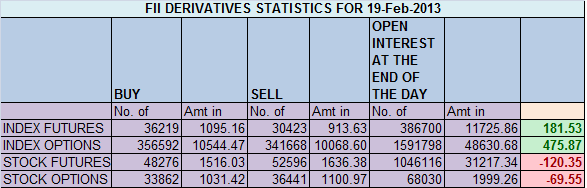

- FIIs bought 5796 contracts of Index Future worth 181.5 (1561 Long contracts were added and 4235 short contract were squared off ) with net Open Interest decreasing by 2674 contracts, so FII’s added longs in index future and shorts were again squared off today.

- Market always rise on wall of worry, I have discussed in weekly analysis 90% of time market moves in direction which cause pain to maximum market participants. Again crowd theory worked and Nifty rose for 4 day in row and closing above its 100 DMA. Closing above 6160 nifty will attempt the gap area of 6188. Hourly charts are overbought and dips near 6100 should be bought into. Nifty has given lots of whipsaws off late , traders holding long as per PAC should part book in range of 6170-6185.

- Nifty Future Feb Open Interest Volume is at 1.56 cores with addition of 0.08 lakhs in Open Interest,so no major activity as volumes were quiet low today.

- Total Future & Option trading volume at 1.18 lakh with total contract traded at 1.2 lakh lowest volume in 2013, PCR (Put to Call Ratio) at 1.09 signalling overbought zone.

- 6200 Nifty CE is having highest OI at 54.2 lakhs , remain resistance for the series but liquidation of 4 lakhs suggests bulls are targeting 6200 in coming days,6100 CE liquidated 5.78 Lakhs suggesting Bulls have conviction of holding 6100.5700-6300 CE liquidated 11.6 Lakh in OI.FII’s bought 4 K contract of CE and 5.2 K shorted CE were covered.

- 6000 PE is having highest OI at 1.16 core, so base at 6000 looks strong. 6100 PE added 7.4 lakhs,having OI at 58.3 lakhs, and 6200 PE added 4.4 lakh suggesting bulls want to close nifty above 6200. 5700-6300 CE added 16.1Lakh in OI .FII’s bought 12.8 K contract of PE and 7.2 K PE were shorted.

- FIIs bought 468 cores in Equity and DII sold 338 cores in cash segment.INR closed at 62.11.

- Nifty Futures Trend Deciding level is 6147 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6072 and BNF Trend Changer Level (Positional Traders) 10286.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6146 Tgt 6166,6185 and 6210(Nifty Spot Levels)

Sell below 6133 Tgt 6120,6100 and 6081 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/