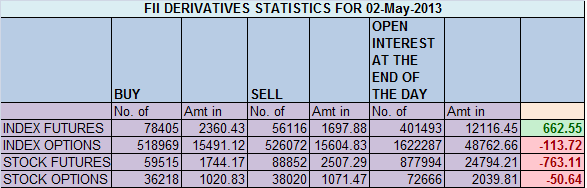

- FIIs bought 22289 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 663 cores with net Open Interest increasing by 46929 contracts.FII’s are entering the RBI policy with long bias. The Big Trader’s Secret

- In yesterday’s analysis we discussed about Nifty forming an exhaustion gap and we were proved wrong by market today as 5971 was crossed. Nifty has crossed 6000 first time after Feb series and we are entering policy with lot of optimism. Buy the rumor Sell news classical stock market adage at work. Traders do remember Nifty and Bank Nifty will be very volatile tomorrow so trade with caution. As discussed in Weekly Analysis Nifty consolidated around 5900 and gave a swift bounce back today achieving all weekly targets. 3 May 2011 Nifty made an 140 points fall and tomorrow again 3 May Will History Repeat itself 🙂

- Nifty Future May Open Interest Volume is at 1.87 cores with addition of 21.9 lakh in Open Interest with rise in Cost of Carry of Nifty Future to showing traders have made long position positions .

- Total Future & Option trading volume at 1.32 lakh with total contract traded at 2.40 lakh , PCR (Put to Call Ratio) has come down substantially at 0.96 from 1.26 on tueday suggesting traders have bought put options and sold calls. VIX Jumped 10% today 16.28 suggesting fear in market participants before the policy, Options IV’s are very high and any disappointment or non event by RBI will lead to premium erosion so be quick in booking profits.

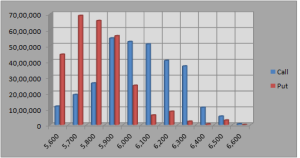

- 5900 Nifty CE is having highest OI at 54.5 lakhs with addition of 4.3 lakhs in OI , 6000-6300 CE added 476.7 lakhs in OI,suggesting lot of speculative activity going on in OTM Calls and its time to be very very cautious.6000 remains the wall of resistance.5500-6200 CE added 38.3 Lakhs in OI

- 5700 Put Option is having highest Open Interest of 68.7 lakhs with addition of 5.9 lakhs in OI ,5800 PE added 2.2 lakhs and net OI at 65 lakhs, 5900 PE added 20 lakhs in OI suggesting any pullback tomorrow near 5900 can be bought into.

- FIIs bought in Equity in tune of 1429 cores,and DII sold 900 cores in cash segment ,INR closed at 53.83 2 months high Live INR Chart for market hours and currency traders

- Nifty Futures Trend Deciding level is 6035 (For Intraday Traders).Nifty Trend Changer Level 5925 and Bank Nifty Trend Changer level 12581

Buy above 6020 Tgt 6042, 6068,6101(Nifty Spot Levels)

Sell below 5975 Tgt 5953,5934 and 5911(Nifty Spot Levels)

Nifty A/D charts is now available at http://

nifty-advance-decline-stocks.bl ogspot.in/ Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863