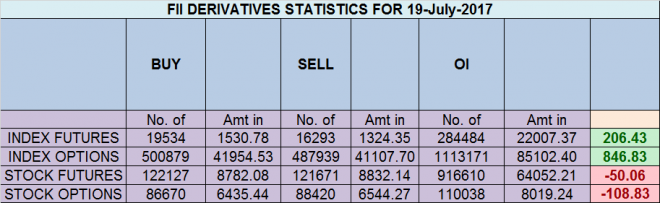

- FII’s bought 3.2 K contract of Index Future worth 206 cores ,2.1 K Long contract were added by FII’s and1 K Short contracts were liquidated by FII’s. Net Open Interest increased by 1 K contract, so rise in market was used by FII’s to enter long and exit short in Index futures. FII’s Long to Short Ratio at 2.1 Can Retail traders make money in Stock market?

- As discussed in last analysis We told below 9792 market will see change in trend low made today was 9792.05 and we saw a bounce back and close above 9820 which was gann angle support as shown in below chart, Now bulls needs to hold on to range of 9792-9787 which is time cycle low for a bounce back towards 9880/9930/9969/10000. Bearish below 9787 for a move towards 9710/9650. Low made today was 9851 and high made was 9905 so nifty did 9880 target today, Again gann analysis kept us above the curve, Nifty held on the gann angle and showed 70 points bounce, till we are holding gann angle low of 9830-9851 we should move up and made new life high at 9930. Above 9930 target are 9969/10000. Bearish below 9787 for a move towards 9710/9650 Bank Nifty Continue to make life high, holding 24000

- Nifty July Future Open Interest Volume is at 1.84 core with liquidation of 4.8 Lakh with increase in cost of carry suggesting short position were covered today, NF Rollover cost @9559 Closed above it, and rallied 400 points.

- Total Future & Option trading volume at 5.44 Lakh core with total contract traded at 0.93 lakh , PCR @1.16

- 10000 CE is having Highest OI at 57.4 lakh, resistance at 10000 followed by 9900 .9600-10000 CE liquidated 33 Lakh in OI so bears ran for cover in 9800-9900 CE as 9787 is still not broken. FII bought 1.7 K CE longs and 5.4 K CE were shorted by them.Retail sold 22.7 K CE contracts and 295 shorted CE were covered by them.

- 9800 PE OI@65 lakhs having the highest OI strong support at 9800 followed by 9700. 9500-10000 PE added 27.8 Lakh in OI so bulls added huge position in 9700-9800 PE . FII bought 13.1 K PE and 3.4 K shorted PE were covered by them. Retail bought 59.2 K PE and 47.6 K PE were shorted by them

- FII’s bought 1046 cores in Equity and DII’s sold 12 cores in cash segment.INR closed at 64.28

- Nifty Futures Trend Deciding level is 9893 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9735. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9905 Tgt 9920,9938 and 9972(Nifty Spot Levels)

Sell below 9880 Tgt 9865,9850 and 9830 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Sir,

34 is a Fibonacci No…will Market crash from there..i mean ultimate correction…