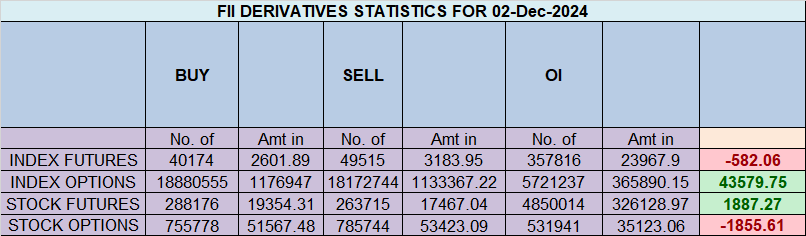

FII Activity: Bullish Sentiment in Nifty Index Futures

Foreign Institutional Investors (FIIs) displayed a bullish approach in the Nifty Index Futures market by buying 3,776 contracts worth ₹236 crores. This resulted in a decrease of 2,250 contracts in the net open interest.

FIIs added 6,881 long contracts and covered 20,086 short contracts, reflecting a preference for building long positions and reducing their short exposure in Nifty Futures. With a net FII long-short ratio of 0.53, it is clear that FIIs strategically utilized the market rise to enter long positions while exiting short positions.

On the other hand, Clients covered 18,139 long contracts and added 3,345 short contracts, indicating a shift toward short-side positioning.

Current Positioning in Index Futures:

- FIIs: Holding 36% long and 64% short positions.

- Clients: Holding 63% long and 37% short positions.

Analysis:

This data highlights a bullish sentiment from FIIs, as they actively added longs and reduced shorts, showing confidence in the market’s upward momentum. Meanwhile, clients appear more cautious, reducing long positions and slightly increasing short positions.

Traders should stay alert to these shifts in positioning, as they could influence market trends in the coming sessions.

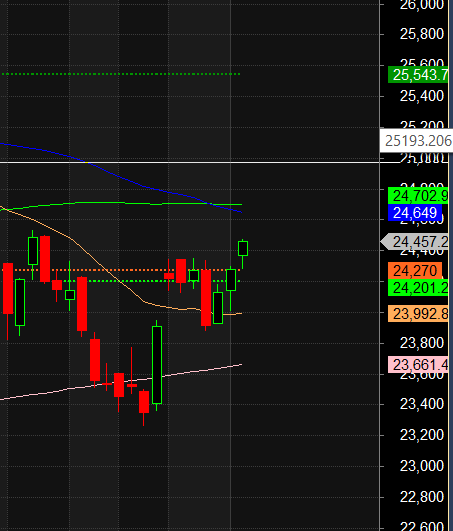

Nifty made a low of 24,008, but as discussed earlier, bad GDP data should not be used as a trigger to short the market. Following this, we saw a strong rally, with the price closing at 24,276.

Seasonality Analysis:

As per historical seasonality data from the last 18 years:

- Nifty was up 12 times, with an average gain of 4%.

- Nifty was down 6 times, with an average loss of 1.8%.

The December month open is at 24,140, and as long as bulls are able to defend this level, the rally can extend toward 24,600/24,888 on the upside.

- For Bears: They will only gain control below the 24,000 level.

Astrological Insight – Bayer Rule 30:

Bayer Rule 30 states: “The trend changes when Venus in declination passes the extreme declination of the Sun.”

This rule will become active tomorrow, making it a critical day for traders.

Trading Strategy for Tomorrow:

- Watch the first 15 minutes’ high and low, as it will set the tone for the day.

- As discussed in the video below, swing trades should only be initiated after 4th December, as the market may consolidate before this date.

Stay cautious and trade with proper risk management, keeping these key levels and insights in mind.

Master the Art of Money Management: Key Secrets Every Trader Must Know

As discussed in our previous analysis, we have witnessed a rally in Nifty. Tomorrow marks a confluence of Gann dates, as both the Gann Anniversary Date and the Gann Emblem Date coincide, creating a critical setup ahead of the RBI policy announcement on 6th December.

Key Levels to Watch:

- Bulls: Bulls would aim to hold the 24,201-24,270 range during any small dips, which serves as a crucial support zone. A sustained hold here could drive a rally toward 24,600-24,700, which is a significant supply zone.

- Bears: Bears will gain momentum if the price breaks below 24,200, signaling potential downside pressure.

Traders should monitor these levels closely and watch for the impact of the Gann dates on market movements, as they could set the tone ahead of the RBI policy.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24473 for a move towards 24551/24628/24700. Bears will get active below 24396 for a move towards 24318/24241/24163.

Traders may watch out for potential intraday reversals at 09:43,11:02,12:48,01:33,02:26 How to Find and Trade Intraday Reversal Times

Nifty December Futures Open Interest Volume stood at 1.16 lakh cr , witnessing liquidation of 1.5 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was liquidation of LONG positions today.

Nifty Advance Decline Ratio at 41:09 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :24201 close above it.

Nifty has closed below its 20 SMA @ 23992 Trend is Buy on Dips till holding 24000.

Nifty options chain shows that the maximum pain point is at 24400 and the put-call ratio (PCR) is at 0.88Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24500 strike, followed by 24600 strikes. On the put side, the highest OI is at the 24300 strike, followed by 24200 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24200-24600 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 3664 crores, while Domestic Institutional Investors (DII) sold 250 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23218-23889-24600 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Don’t trade when you’re tired or emotional. (angry and upset) Trading is a complex activity, and it’s important to be mentally sharp when you’re trading. If you’re tired or emotional, it’s best to take a break from trading.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24333. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24520, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24484 Tgt 24525, 24575 and 24612 ( Nifty Spot Levels)

Sell Below 24430 Tgt 24380, 24323 and 24270 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.