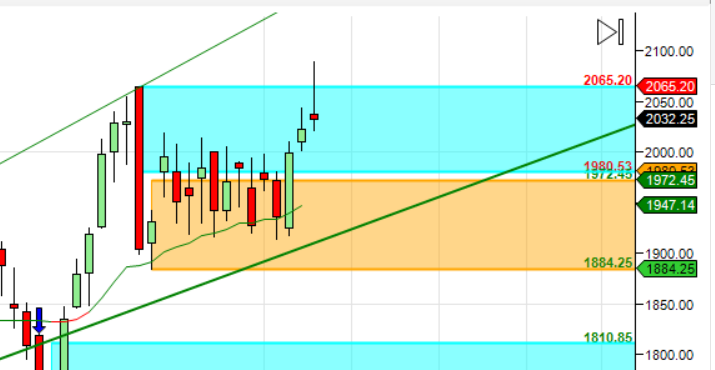

OBEROI Realty

Positional Traders can use the below mentioned levels

Close above 2040 Target 2100

Intraday Traders can use the below mentioned levels

Buy above 2040 Tgt 2065, 2080 and 2100 SL 2025

Sell below 2020 Tgt 2008, 1990 and 1975 SL 2030

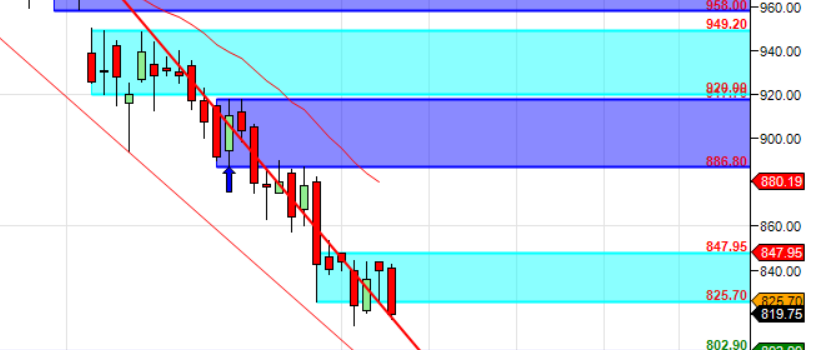

TATA MOTORS

Positional Traders can use the below mentioned levels

Close above 825 Target 888

Intraday Traders can use the below mentioned levels

Buy above 825 Tgt 835, 844 and 856 SL 820

Sell below 816 Tgt 808, 800 and 792 SL 820

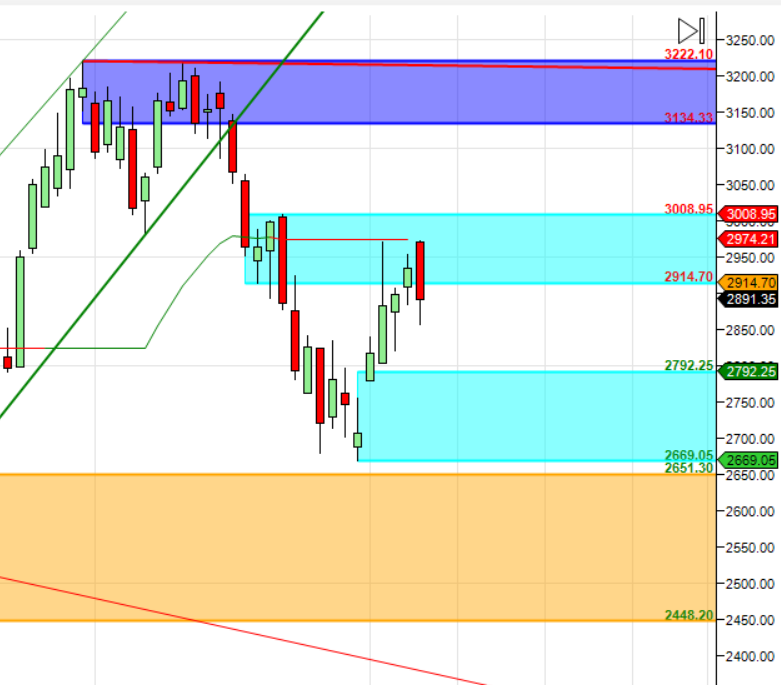

M&M

Positional Traders can use the below mentioned levels

Close above 2916 Target 2996

Intraday Traders can use the below mentioned levels

Buy above 2916 Tgt 2930, 2966 and 2996 SL 2910

Sell below 2905 Tgt 2890, 2866 and 2833 SL 2911

I am not a SEBI Registered Advisor, and the analysis provided on this website is intended solely for educational purposes. It is important to note that the information presented should not be construed as financial advice. We do not guarantee the accuracy or completeness of the content, and any decisions based on the information provided are at your own risk.

WE do not haev any kind of advisory services. We do not have any Telegram or Whatsapp Channel. Views Shared Here are our Online Trading Journal.

Please be aware that investing in financial markets involves inherent risks, and past performance is not indicative of future results. We, the authors and contributors, shall not be held responsible for any financial outcomes, including but not limited to profit or loss, arising from the use of the information on this website.

It is strongly recommended that you seek the advice of a qualified investment professional or a SEBI Registered Advisor before making any investment decisions. Your financial situation, risk tolerance, and investment goals should be carefully considered before implementing any strategies discussed on this platform.

Additionally, we may not be aware of your specific financial circumstances, and our content should not be considered a substitute for personalized advice. Always conduct thorough research and consult with your own investment advisor to ensure that any investment decisions align with your individual financial objectives.

By accessing and using the information provided on this website, you acknowledge and agree that you are solely responsible for your investment decisions. We disclaim any liability for any direct or indirect damages, including financial losses, that may result from the use of or reliance on the information presented here.

How to trade Intraday and Positional Stocks Analysis — Click on this link

As always I wish you maximum health and trading success

-

All prices relate to the NSE Spot/Cash Market

-

Calls are based on the previous trading day’s price activity.

-

Intraday call is valid for the next trading session only unless otherwise mentioned.

-

Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

-

Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.