Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 49146 contracts worth 5450 crores, resulting in a increase of 19414 contracts in the Net Open Interest. FIIs covered 26359 long contracts and 44736 short contracts were added by them , indicating a preference for covering LONG and adding SHORT positions .With a Net FII Long Short ratio of 1.41 FIIs utilized the market fall to exit Long positions and enter short positions in NIFTY Futures. Clients have added 46180 long and 500 Shorts were added by them.

Nifty experienced a significant fall due to the Solar Eclipse 180 Degree effect and the Sun conjunct Mercury, as discussed below. Currently, Nifty is near its 50 SMA, indicating a potential bounce as long as it holds above 22080 on the downside. Today’s market opening at 09:15 is crucial for setting the trend of the day, with the first five minutes being particularly important.

Additionally, Infosys is announcing its results today, which may lead to big move as Infosys’s is having second highest weightage in Index, Overnight Crude has seen a siginificant fall which will short term mpositive, If Nifty falls below 22080 bears may witness a sharp drop toward 21952.

Tomorrow is an important day with key astro dates, so a significant move could be expected.

Israel has conducted an attack, which is expected to impact market openings significantly. The Nifty is likely to open with a gap down 21750 should be watched out for swing traders,Intraday traders should closely monitor the high and low of the first 15 minutes of trading to determine the day’s trend.

Today also sees a conjunction of Mercury and Venus, two inner planets known for causing swift market movements. This emphasizes the need for traders to be flexible and agile in their approach. Adaptability and quick decision-making will be key to navigating the market dynamics effectively today.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 21952 for a move towards 22027/22102/22177 . Bears will get active below 21803 for a move towards 21728/21666/21610

Traders may watch out for potential intraday reversals at 9:45,11:49,12:36,2:01 How to Find and Trade Intraday Reversal Times

Nifty April Futures Open Interest Volume stood at 1.14 lakh cr , witnessing a addition of 4.5 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 14:36 and Nifty Rollover Cost is @22327 closed above it.

Nifty Gann Monthly Trade level :22455 below it above it.

Nifty has closed above its 20/30 DMA suggesting trend is Sell on Rise till we are below 22300 — HIgh made 22326 and turned back

Nifty options chain shows that the maximum pain point is at 21800 and the put-call ratio (PCR) is at 0.81. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 21800 strike, followed by 21900 strikes. On the put side, the highest OI is at the 22000 strike, followed by 22100 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 21800-22000 levels.

According To Todays Data, Retailers Have sold 294 K Call Option Contracts And 226 K Call Option Contracts Were Shorted by them. Additionally, They sold 333 K Put Option Contracts And 148 K Put Option Contracts were Shorted by them, Indicating A Bullish Bias.

In Contrast, Foreign Institutional Investors (FIIs) bought 3189 Call Option Contracts And 114 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 64.3 K Put Option Contracts And 27.9 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To Bearish Bias.

In the cash segment, Foreign Institutional Investors (FII) sold 4260 crores, while Domestic Institutional Investors (DII) bought 2285 crores.

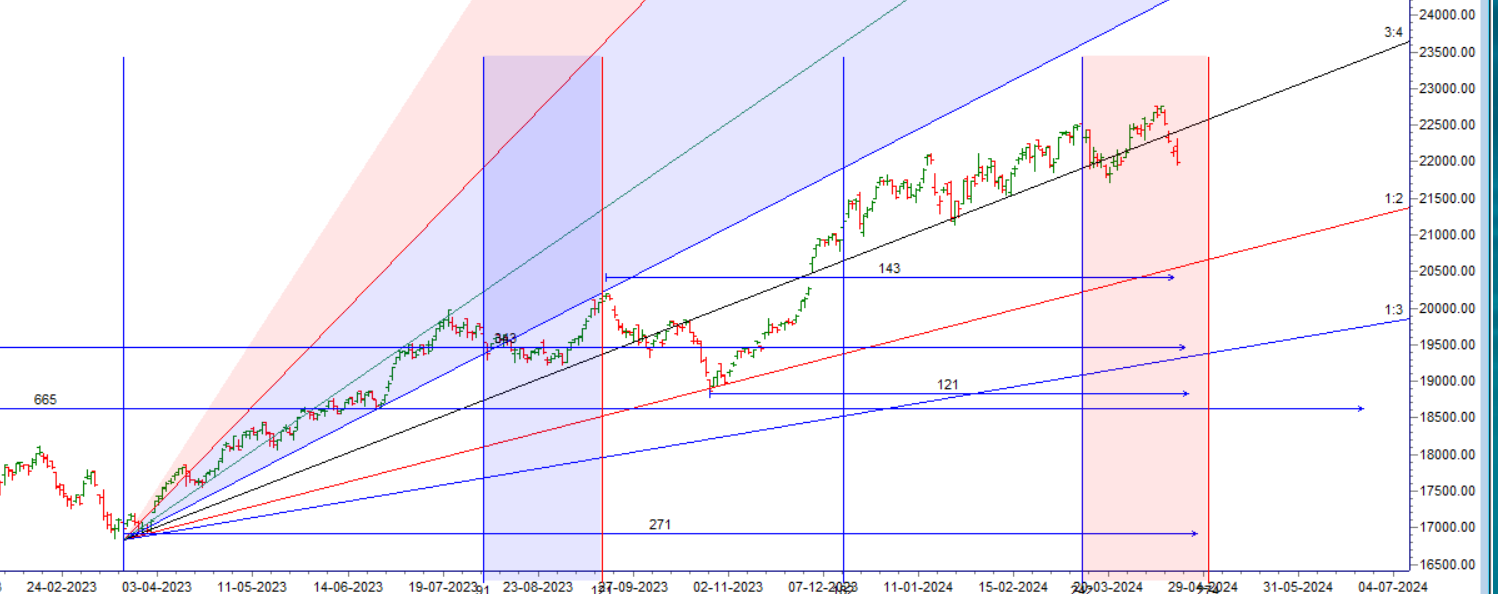

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 21775-22404-23071 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

If you don’t trust the system while you’re in a trade, you’ll become impatient. Impatience makes you exit too soon – afraid that profits will dissipate – or too late, because you don’t want to take a loss.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 22258. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 22181 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 21800 Tgt 21824, 21860 and 21900 ( Nifty Spot Levels)

Sell Below 21750 Tgt 21721, 21685 and 21636 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.