Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 22976 contracts worth 2554 crores, resulting in a increase of 3214 contracts in the Net Open Interest. FIIs sold 12630 long contracts and 18754 short contracts were added by them , indicating a preference for covering LONG and adding SHORT positions .With a Net FII Long Short ratio of 1.03 FIIs utilized the market fall to exit Long positions and enter short positions in NIFTY Futures. Clients have added 14279 long and 23434 Shorts were covered by them.

NIfty made a new Life High today made O=H and closed at lowest point of the day, Tommrow we have Mars Conjunct Saturn aspect, Mars is Plannet of Energy and Saturn is a planet of restriction and contraction, SO tommorow we can see a trending move due to this aspect. 11 APril is a trading Holiday but tommrow we will get UP CPI data which will lead to Gap up or gap down open on Friday so carry overnight position with hedge. TIll Price is Holding 22527 Bulls will have upper hand. For Trading watch for first 15 Mins High and Low to capture trend of the day.

Nifty experienced a significant fall due to the Solar Eclipse 180 Degree effect and the Sun conjunct Mercury, as discussed below. Currently, Nifty is near its 50 SMA, indicating a potential bounce as long as it holds above 22080 on the downside. Today’s market opening at 09:15 is crucial for setting the trend of the day, with the first five minutes being particularly important.

Additionally, Infosys is announcing its results today, which may lead to big move as Infosys’s is having second highest weightage in Index, Overnight Crude has seen a siginificant fall which will short term mpositive, If Nifty falls below 22080 bears may witness a sharp drop toward 21952.

Tomorrow is an important day with key astro dates, so a significant move could be expected.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 22202 for a move towards 22277/22352/22427 . Bears will get active below 22127 for a move towards 22053/21975/21903.

Traders may watch out for potential intraday reversals at 9:15,11:13,12:08,2:04,2:29 How to Find and Trade Intraday Reversal Times

Nifty April Futures Open Interest Volume stood at 1.10 lakh cr , witnessing a liquidationof 0.58 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a liquidation of SHORT positions today.

Nifty Advance Decline Ratio at 15:34 and Nifty Rollover Cost is @22327 closed above it.

Nifty Gann Monthly Trade level :22455 below it above it.

Nifty has closed above its 20/30 DMA suggesting trend is Sell on Rise till we are below 22300

Nifty options chain shows that the maximum pain point is at 22200 and the put-call ratio (PCR) is at 0.87. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 22300 strike, followed by 22400 strikes. On the put side, the highest OI is at the 22100 strike, followed by 22000 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 22500-22700 levels.

According To Todays Data, Retailers Have sold 750 K Call Option Contracts And 801 K Call Option Contracts Were Shorted by them. Additionally, They sold 258 K Put Option Contracts And 229 K Put Option Contracts were Shorted by them, Indicating A Bullish Bias.

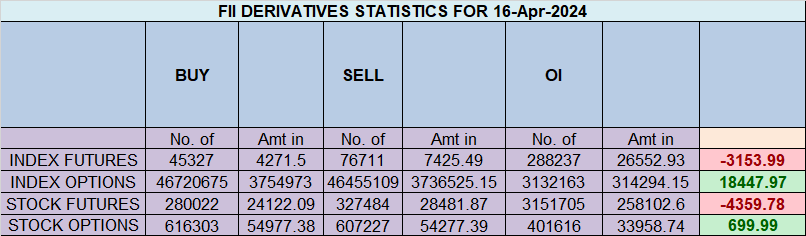

In Contrast, Foreign Institutional Investors (FIIs) sold 345 K Call Option Contracts And 213 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs sold 491 K Put Option Contracts And 505 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To Bearish Bias.

In the cash segment, Foreign Institutional Investors (FII) sold 4468 crores, while Domestic Institutional Investors (DII) bought 2040 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 21775-22404-23071 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

If you don’t trust the system while you’re in a trade, you’ll become impatient. Impatience makes you exit too soon – afraid that profits will dissipate – or too late, because you don’t want to take a loss.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 22572. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 22188, Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 22293

Lower End of Expiry : 22000

Nifty Intraday Trading Levels

Buy Above 22166 Tgt 22199, 22255 and 22293( Nifty Spot Levels)

Sell Below 22108 Tgt 22066, 22033 and 22000 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.