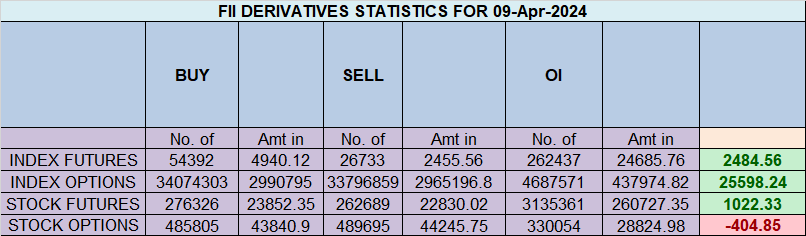

Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 11184 contracts worth 1276 crores, resulting in a increase of 10244 contracts in the Net Open Interest. FIIs added 20375 long contracts and 7284 short contracts were covered by them , indicating a preference for covering LONG and covering SHORT positions .With a Net FII Long Short ratio of 0.77 FIIs utilized the market rise to enter Long positions and exit short positions in NIFTY Futures. Clients have added 3921 long and 21762 Shorts were added by them.

North Node did its work and we saw huge voaltlity in the market. Now Tommrow we have RBI Policy at 10 AM and Venus Ingress, Venus is one of the closest planets to Earth, meaning that its Ingress are more powerful and intense than other planets. It has us rethinking and reassessing all this Venusian: relationships, affection, money, pleasure, and art. Nifty has formed Multiple Outsdie Bar in last 2 trading session and today we had an all time high closing. Tomorrow first 15 mins High and Low will decide the trend of the day.

NIfty made a new Life High today made O=H and closed at lowest point of the day, Tommrow we have Mars Conjunct Saturn aspect, Mars is Plannet of Energy and Saturn is a planet of restriction and contraction, SO tommorow we can see a trending move due to this aspect. 11 APril is a trading Holiday but tommrow we will get UP CPI data which will lead to Gap up or gap down open on Friday so carry overnight position with hedge. TIll Price is Holding 22527 Bulls will have upper hand. For Trading watch for first 15 Mins High and Low to capture trend of the day.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 22693 for a move towards 22768/22824/22899 . Bears will get active below 22542 for a move towards22466/22391/22315.

Traders may watch out for potential intraday reversals at 9:21,12:46,1:59,2:28 How to Find and Trade Intraday Reversal Times

Nifty April Futures Open Interest Volume stood at 1.14 lakh cr , witnessing a addition of 9.5 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 16:34 and Nifty Rollover Cost is @22327 closed above it.

Nifty Gann Monthly Trade level :22455 closed above it.

Nifty has closed above its 20/30 DMA suggesting trend is buy on dips till we are holding 22527 — Price has closed above 22527

Nifty options chain shows that the maximum pain point is at 22650 and the put-call ratio (PCR) is at 0.96. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 22700 strike, followed by 22800 strikes. On the put side, the highest OI is at the 22500 strike, followed by 22400 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 22500-22700 levels.

According To Todays Data, Retailers Have bought 422 K Call Option Contracts And 397 K Call Option Contracts Were Shorted by them. Additionally, They sold 283 K Put Option Contracts And 115 K Put Option Contracts were Shorted by them, Indicating A Bullish Bias.

In Contrast, Foreign Institutional Investors (FIIs) bought 133 K Call Option Contracts And 34 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 174 K Put Option Contracts And 119 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To Bearish Bias.

In the cash segment, Foreign Institutional Investors (FII) sold 593 crores, while Domestic Institutional Investors (DII) bought 2257 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 21775-22404-23071 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

The most difficult thing for any trader to do is isolate the emotional part of his thinking and keep it from interfering with his trading. One of the best ways to accomplish this task is to plan and place both the entry point and price objective before you make the trade.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 22602. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 22778 , Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 22776

Lower End of Expiry : 22507

Nifty Intraday Trading Levels

Buy Above 22666 Tgt 22699, 22729 and 22777 ( Nifty Spot Levels)

Sell Below 22595 Tgt 22560, 22525 and 22500 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.