As Discussed in Last Analysis Price continue to make higher high and closed above 1×1 gann angle as shown in below chart , with RBI putting hold to Intrest Rate Hike, 11 April is important gann and astro date so should be watched very closely. With RBI Holding on the Intrest Rate Bank Nifty underperforming and tommrow Jupiter Conjunct Sun Aspect which is very important as discussed in below video. Price is back to 1×1 gann angle and back to 50% point as shown in below 2 charts potentalliy forming Gann Price time Squaring.

Swing Traders need to move above 40938 for a move towards 41139/41341/41542. Bears will get chance below 40729 for a move towards 40535/40225/40000.

Traders may watch out for potential intraday reversals at 9:41,11:15,12:41,1:46,2:19 How to Find and Trade Intraday Reversal Times

Bank Nifty April Futures Open Interest Volume stood at 21.7 lakh, liquidation of 1.9 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of longs positions today.

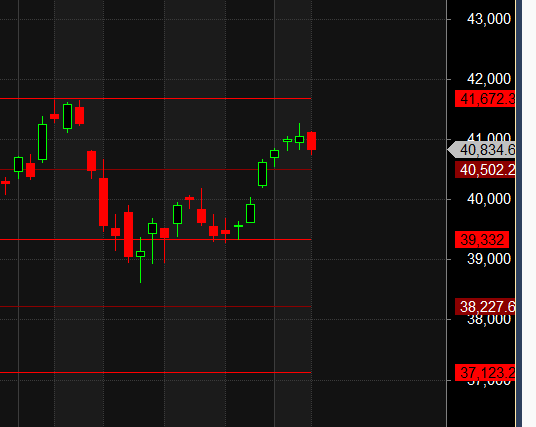

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 38227-39332-40502-41672. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels.

Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 41000 strike, followed by the 41300 strike. On the put side, the 40500 strike has the highest OI, followed by the 40300 strike. This indicates that market participants anticipate Bank Nifty to stay within the39500-40000 range.

The Bank Nifty options chain shows that the maximum pain point is at 40500 and the put-call ratio (PCR) is at 1.09. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

The Market Doesn’t Give a Damn What You Think, about your economic or political views. Trade what the market is doing, not what you’d like it to do in your wildest fantasies.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 40856 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 41062 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels:

Buy above 42933 with targets at 41073, 41225 and 41385 Bank Nifty Spot Levels)

Sell below 40725 with targets at 40610, 40488 and 40225 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.