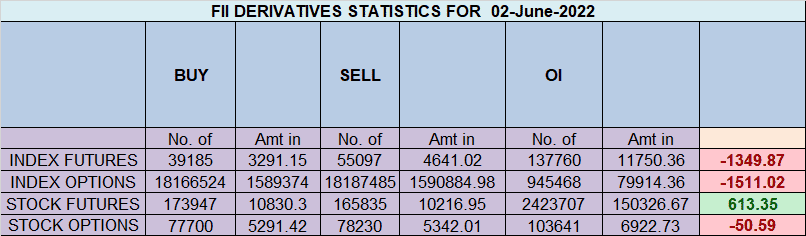

FII sold 15.9 K contract of Index Future worth 1349 cores, Net OI has decreased by 12.6 K contract 14.2 K Long contract were covered by FII and 1.6 K Shorts were added by FII. Net FII Long Short ratio at 0.65 so FII used rise to exit long and enter short in Index Futures.

As discussed in Last Analysis It was day of whipsaw both bulls and bears got sl triggred, its part of the game and we need to accept it. Swing Traders Longs above 16567 for a move towards 16631/16695/16759. Bears will get active below 16437 for a move towards 16372/16307/16243. Today we did not got the big move so tommrow we should see explosive expiry. Low made was 16443 so bears unable to break 16437 and Bulls once above 16567 did 16631 and today with gap up will do all target on upside. Now today Mecury Turns Direct and with 150+ gap up opening most of move will be captured in gap up thats why Swing levels are so important. Swing Traders Longs above 16763 for a move towards 16827/16891/16956. Bears will get active below 16699 for a move towards 16635/16571/16507.

Intraday time for reversal can be at 10:36/11:29/12/1:33/2:10 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16600 PCR at 0.86 PCR below 0.89 and above 1.3 lead to trending moves, and in between leads to range bound markets.Nifty rollover cost @ 16139and Rollover @69.6 %.

Nifty May Future Open Interest Volume is at 1.07 Cores with addition of 3.3 Lakh with increase in cost of carry suggesting LONG positions were added today.

Maximum Call open interest of 21 lakh contracts was seen at 16700 strike, which will act as a crucial resistance level and Maximum PUT open interest of 21 lakh contracts was seen at 16500 strike, which will act as a crucial Support level

FII’s sold 451 cores and DII’s bought 130 cores in cash segment.INR closed at 77.77

Nifty has closed above the Gann Trend Change Level of 16625 and this time should head towards 16836.

There is only 1 final top and 1 final bottom Shorting top everyday or buying bottom everyday is the road to ruin.

For Positional Traders Stay long till we are holding Trend Change Level 16441 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 16544 will act as a Intraday Trend Change Level.