FII bought 22.2 K contract of Index Future worth 1806 cores, Net OI has increased by 3.3 K contract 12.8 K Long contract were added by FII and 9.4 K Shorts were covered by FII. Net FII Long Short ratio at 1.25 so FII used rise to enter long and exit short in Index Futures.

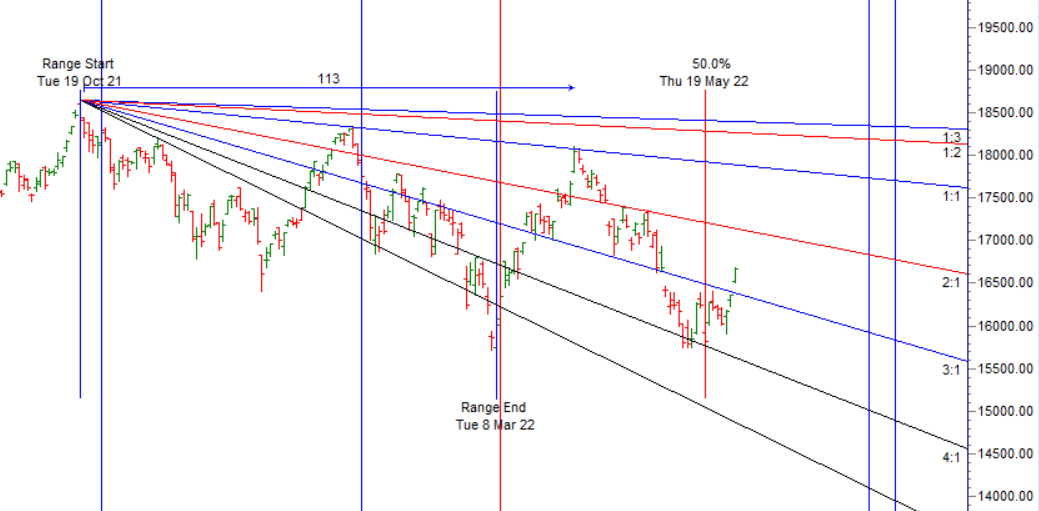

As discussed in Last Analysis So Combo of Astro and Gann date created a lethal combo and led to move 150+ point in nifty and we were able to capture the bottom as discussed on twitter 30 May is another important astro date which will come on MOnday so aviod carrying overnight positions without Hedge. Swing Traders Longs above 16282 for a move towards 16345/16408. Bears will get active below 16155 for a move towards 16092/16029/15966. We have seen perfect rise in nifty and breakout above the gann angle resistance. We have discussed the importance of astro cycle in below video. Swing Traders Longs above 16700 for a move towards 16763/16827/16891. Bears will get active below 16570 for a move towards 16506/16444/16385.

Intraday time for reversal can be at 10:06/11:47/12:24/1:49/2:24 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16500 PCR at 0.88 PCR below 0.89 and above 1.3 lead to trending moves, and in between leads to range bound markets.Nifty rollover cost @ 16139and Rollover @69.6 %.

Nifty May Future Open Interest Volume is at 1.14 Cores with addition of 2.2 Lakh with decrease in cost of carry suggesting LONG positions were closed today.

Maximum Call open interest of 51 lakh contracts was seen at 16500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 31 lakh contracts was seen at 16800 strike, which will act as a crucial Support level

FII’s bought 502 cores and DII’s bought 1524 cores in cash segment.INR closed at 77.52

Retailers have bought 467 K CE contracts and 364 K CE contracts were shorted by them on Put Side Retailers bought 586 K PE contracts and 498 K PE shorted contracts were added by them suggesting having BULLISH outlook,On Flip Side FII bought 26.7 K CE contracts and 26.2 K CE were shorted by them, On Put side FII’s bought 8.2 K PE and 4.1 K PE were shorted by them suggesting they have a turned to Bearish Bias.

When it comes to trading, professionals are able to do the right thing as naturally as breathing. You no longer have to think about what is right and what is wrong. They act automatically based on their knowledge, experience and skills. They don’t invent opportunities, they find them and then implement them with the help of the behaviour they have learned.

For Positional Traders Stay long till we are holding Trend Change Level 16320 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 16610 will act as a Intraday Trend Change Level.