JSW STEEL

Positional Traders can use the below mentioned levels

Close below 721 Target 699

Intraday Traders can use the below mentioned levels

Buy above 735 Tgt 743, 750 and 756 SL 729

Sell below 721 Tgt 714, 707 and 699 SL 729

BEL

Positional Traders can use the below mentioned levels

Close above 156 Target 162

Intraday Traders can use the below mentioned levels

Buy above 154.5 Tgt 156, 157.5 and 159 SL 153.5

Sell below 152.5 Tgt 151, 149.5 and 148 SL 153.5

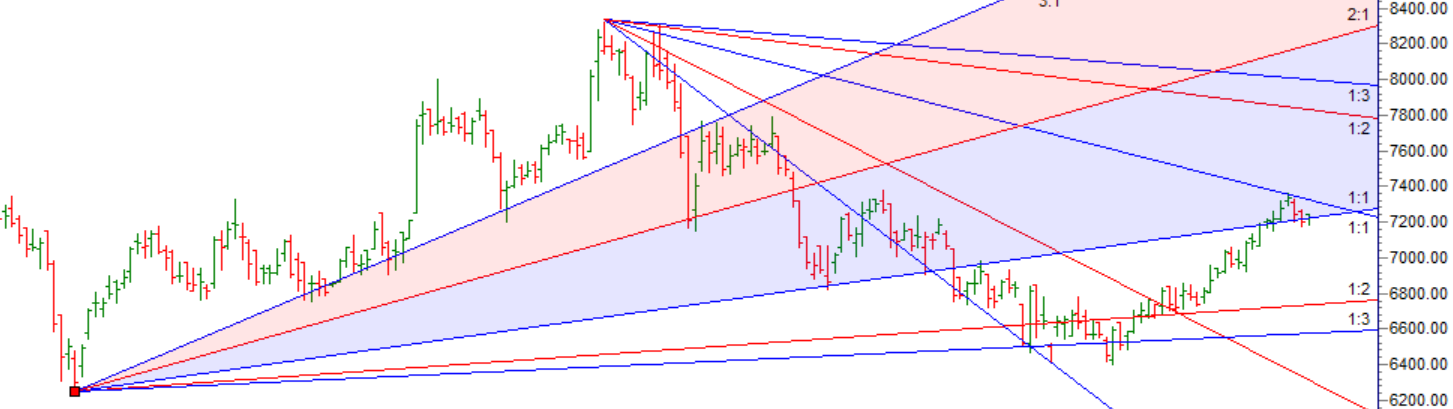

MARUTI

Positional Traders can use the below mentioned levels

Close below 7150 Target 7000

Intraday Traders can use the below mentioned levels

Buy above 7226 Tgt 7261, 7310 and 7366 SL 7190

Sell below 7150 Tgt 7100, 7050 and 7000 SL 7180

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is discussed for May Month, Intraday Profit of 2.75 Lakh and Positional Profit of 3.74 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if Trading Systems are followed with discipline. Performance “Will differ” from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.