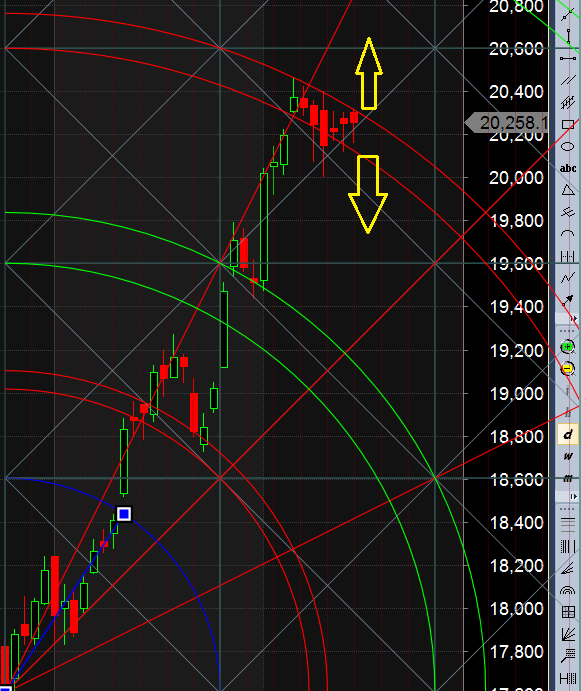

- As discussed in Last Analysis Gann Arc again came to rescue of bulls, Its been 6 trading days we are stuck in gann arc suggesting trending move is round the corner, We were expecting the move to come but market did not oblige, cycles gets delayed by 1-2 days lets see if the move comes in next 2 days, Bullish above 20350 for move towards 20500/20750/21000. Bearish below 20000 for move towards 19750/19500. 15 Feb is important date as per time analysis,hopefully we should see trending move tomorrow. Trading Common Sense which is not so Common

- Bank Nifty Feb Future Open Interest Volume is at 28.2 lakh with liquidation of 0.08 lakh, with decrease in Cost of Carry suggesting Long positions were closed today. Bank nifty Rollover cost @19080.

- 21000 CE is having highest OI @7.1 Lakh resistance at 20500 followed by 21000. 19000-21000 CE saw addition of 0.54 lakh in OI so bears added in 20500-21000 CE.

- 19500 PE is having highest OI @6.7 Lakh, strong support at 19500 followed by 19000, Bulls added 0.30 Lakh in OI in range of 19000-21000 bulls added in 19200 PE.

- Bank Nifty Futures Trend Deciding level is 20252 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 20050 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 20300 Tgt 20370,20430 and 20550 (Bank Nifty Spot Levels)

Sell below 20150 Tgt 20080,20000 and 19850 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Click Here to Join me on Twitter

HAI SIR

SIR JI Bank Nifty Futures Trend Deciding level is 20262 Am I Right SIR JI.

Levels mentioned is correct,,

Trend Deciding level 20262 am i right ramesh ji