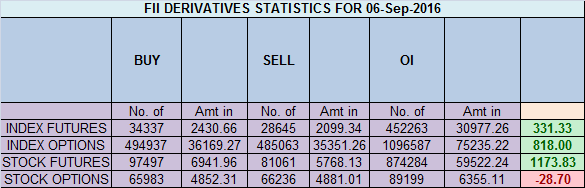

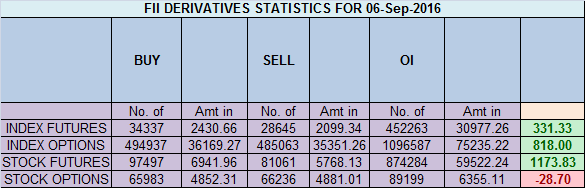

- FII’s sold 5.6 K contract of Index Future worth 331 cores ,9.7 K Long contract were added by FII’s and 4 K short contracts were added by FII’s. Net Open Interest decreased by 13.7 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. Do Not Limit Yourself

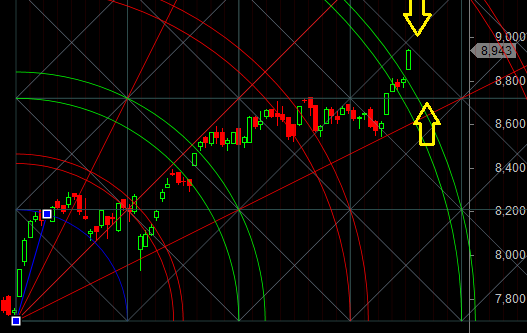

- As discussed in past Analysis on 01 Aug Close above 8677 Nifty can make next move till 8800/8951. Bearish only on close below 8490 and bullish on close above 8677 in between yo-yo move Gann Analysis gives an edge in market as its based on vibration and things which has happened in past will repeat again, High made today was 8950.85 just .15 point short of 8951. Now 8951 will become the new 8577. Closing above it Nifty can move all the way towards 9045/9189/9334,Closing below it 8856/8716/8622 are the targets for the September series. and below it Bank Nifty near Wolf Wave Target, EOD Analysis

- Nifty Sep Future Open Interest Volume is at 3.38 core with liquidation of 7.2 Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @8686, closed above it rallied 250 points.

- Total Future & Option trading volume was at 3.27 Lakh core with total contract traded at 1.07 lakh , PCR @1.12 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 58.8 lakh, resistance at 9000 .8500/9000 CE liquidated 23 lakh so finally bears gave up on 8900 .FII bought 15.7 K CE longs and 0.7 K CE were shorted by them .Retail sold 9.7 K CE contracts and8.4 K CE were shorted by them.

- 8600 PE OI@63.1 lakhs having the highest OI strong support at 8600. 8300-8800 PE added 24.6 Lakh in OI so bulls making strong base near 8700-8750 zone .FII bought 11.8 K PE longs and 18.5 K PE were shorted by them .Retail bought 101 K PE contracts and 56.7 K PE were shorted by them.

- FII’s bought 1438 cores in Equity and DII’s sold 268 cores in cash segment.INR closed at 66.52

- Nifty Futures Trend Deciding level is 8928 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8760 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8951 Tgt 8979,8999 and 9020 (Nifty Spot Levels)

Sell below 8910 Tgt 8888,8860 and 8840 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

sir i want to learn pivot points trading…do u have any course fr it…simple or carmilla

Please check first para. It is from last friday’s post. Need to be updated.

FII figs for Index fut are on the BUY side…

thanks corrected…