- FII’s bought 964 contract of Index Future worth 83 cores ,14.9 K Long contract were added by FII’s and 13.9 K short contracts were added by FII’s. Net Open Interest increased by 28.9 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. Trading Confidence

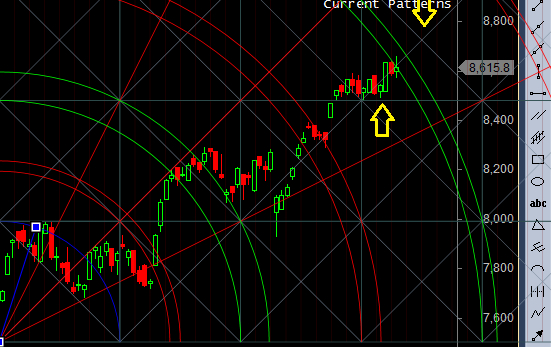

- As discussed in Yesterday Analysis Now the zone of 8654-8677 is crucial supply zone, closing above 8677 level again can see fast move till 8849. We have resistance zone at every 100-150 points as market has spend lot of time in this range during the 2015 year. Bearish on close below 8490 only. Holding 8577 again another attempt can be made to break 8650 range.High made today was 8665 and low made was 8572, so gann number of 8577 again showed its importance as we got the desired move till 8665. Its always good to go with flow of trend instead of trying to predict the top, and shorting blindly everyday. Bearish only on close below 8490 and bullish on close above 8677. Bank Nifty close above 19000 before July Expiry,EOD Analysis

- Nifty July Future Open Interest Volume is at 1.76 core with liquidation of 27 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover is at 73% and Rollover cost @8204 closed above it

- Total Future & Option trading volume was at 6.86 Lakh core with total contract traded at 2.07 lakh , PCR @0.95 , Trader’s Resolutions for the New Financial Year 2016-17

- 8700 CE is having Highest OI at 61.7 lakh, resistance at 8700 .8500/8700 CE added 5.7 lakh another failed attempt to break 8650 .FII bought 13.2 K CE longs and 5.1 K shorted CE were covered by them .Retail bought 15.5 K CE contracts and 13.8 K CE were shorted by them.

- 8500 PE OI@53.2 lakhs having the highest OI strong support at 8500. 8500-8700 PE added 13.5 Lakh in OI so bulls making strong base near 8500-8550 zone .FII bought 0.7 K PE longs and 2.1 K PE were shorted by them .Retail sold 30.5 K PE contracts and 3.5 K shorted PE were covered by them.

- FII’s bought 404 cores in Equity and DII’s sold 152 cores in cash segment.INR closed at 67.14

- Nifty Futures Trend Deciding level is 8614 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8490How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8620 Tgt 8645,8665 and 8710 (Nifty Spot Levels)

Sell below 8570 Tgt 8550,8525 and 8480 (Nifty Spot Levels)

Upper End of Expiry : 8685

Lower End of Expiry : 8546

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Any hourly bar close above 8645 will take nifty to 8665. Break of 8665 will give targets of 8690/8722. We can expect these targets tomorrow i.e. on expiry day.