Last week we gave the Chopad level of 18426 Bank Nifty achieved 2 target on upside and 1 target on downside rewarding discipline chopad followers .Lets analyze how to trade next week as RBI policy in 2 June.

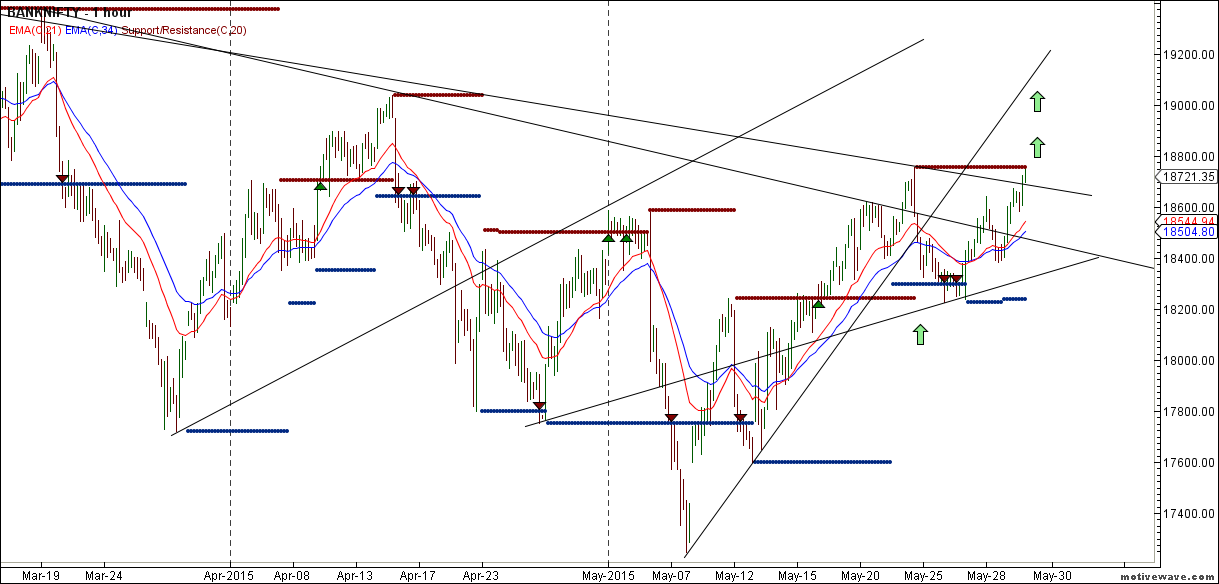

Bank Nifty Hourly

Bank Nifty broke its trendline and also closed above its 21/34 EMA, suggesting break of 18750 can see move towards 18900/19038 is on cards. Bearish below 18550 only.

Bank Nifty Hourly EW Daily

Hourly Elliot wave analysis is shown, 18750 will play crucial levels next week.

Bank Nifty Pyrapoint Indicator

Traded well in the range of Pyrapoint Analysis Support @135 degree line , resistance at 90 degree line.

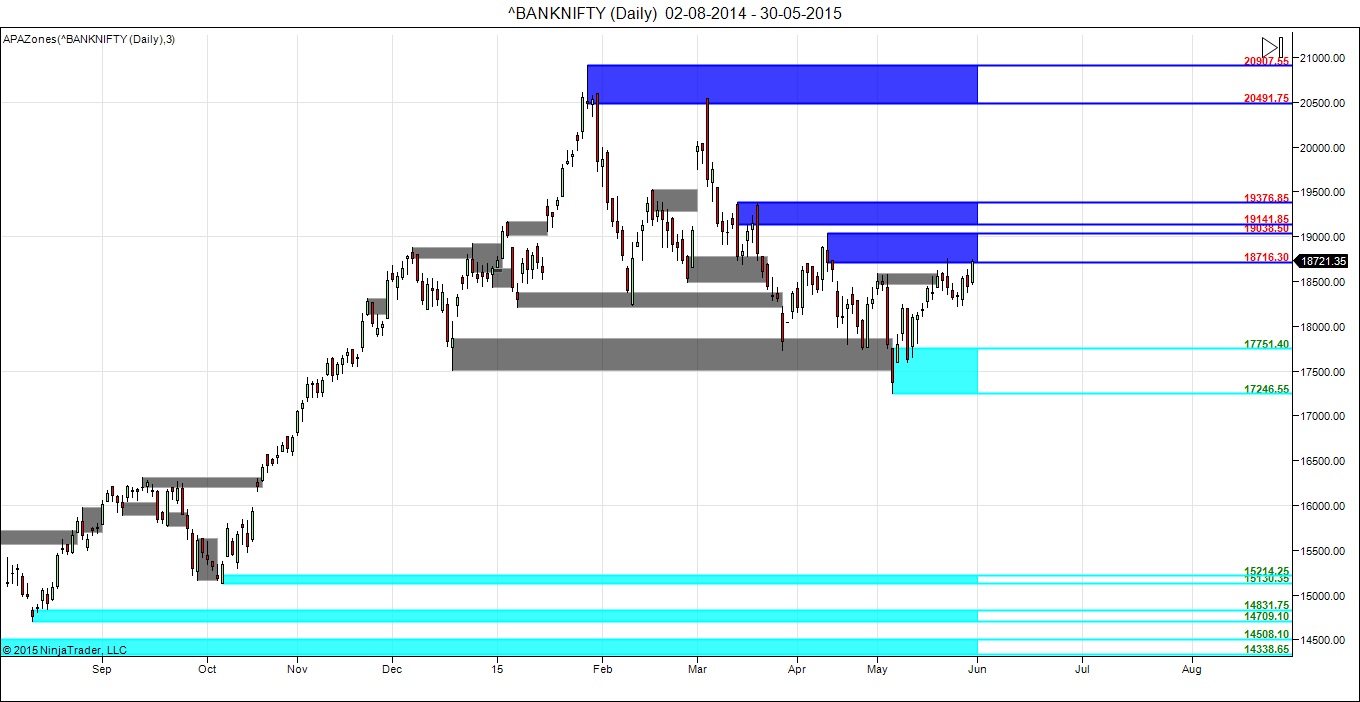

Supply Demand Zone

Self Explanatory chart depicting Supply and Demand zone. Again entered the Supply zone sustain above it can see 19038 odd levels.

Bank Nifty Channel

Range contraction between 100/50 SMA suggesting expansion of price on cards with increasing volatility.

Bank Nifty Harmonic

As discussed in last week analysis Next round of up move above 18260 for 18500/18600.

Done all target of Harmonic pattern

Bank Nifty EW Daily

Use dips to keep accumulation quality banking stocks. Long term targets are still pending as shown above.

Murry Math Line

Break of MML blue line can see it moving towards 18900/19038

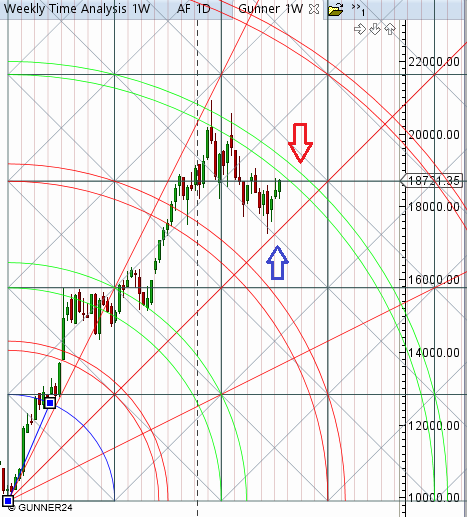

Bank Nifty Daily Gunner

On Daily chart near important Gunner resistance @1*2 line,close above it will lead to trend change

Bank Nifty Gann Dates

Nifty As per time analysis 02 June/05 June is Gann Turn date , except a impulsive around this dates. Last week we gave 26 May/28 May Nifty saw a volatile move .

Gann Emblem

3 June is Gann Emblem Date.

Fibonacci technique

Fibonacci Fans

Close near its 38.2 % retracement as per FF

38.2/50 % number is 18645/18894/19077 should be watched.

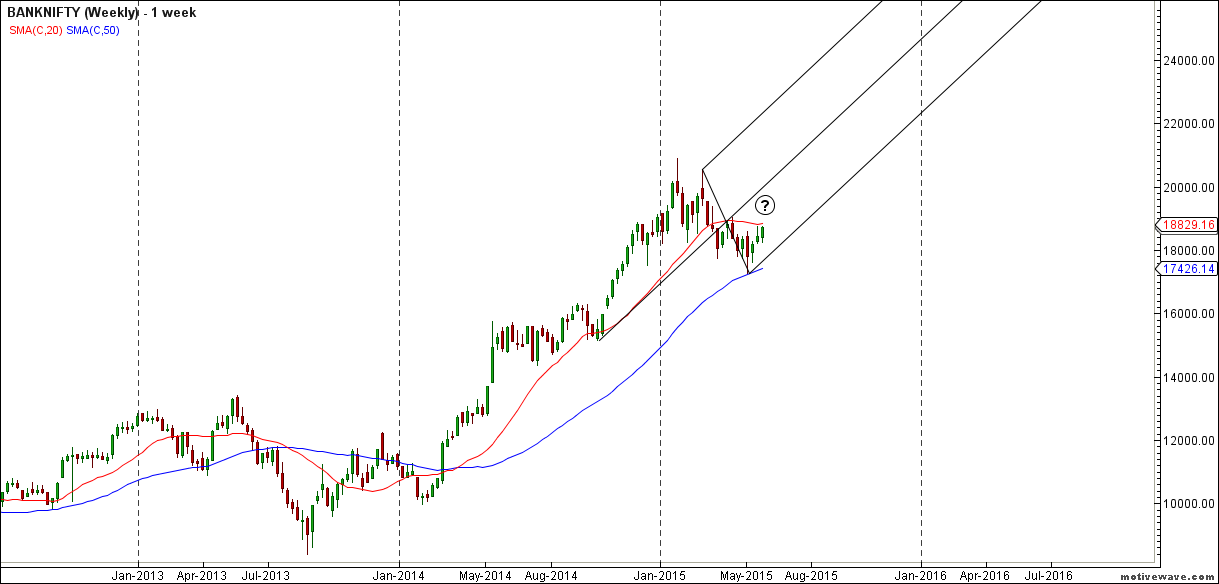

Bank Nifty Weekly

It was positive week, with the Bank Nifty up by 288 points closing @18751 , price again got rejected near its 20 WSMA and holding 50 WSMA .Bulls will get momentum above 20 WSMA only support at 18200 range. We are in neutral to negative time cycle till 14 JUne.

Bank Nifty Weekly Gunner

Bank Nifty Monthly

Bank Nifty On Monthly chart prices got reject on higher end of Fibonacci channel now held the 61.8% retracement.

Bank Nifty Weekly Chopad Levels

Bank Nifty Trend Deciding Level:18816

Bank Nifty Resistance:18946,19076,19336

Bank Nifty Support:18686,18426,18166

Levels mentioned are Bank Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Thanks for all the view points. Sometimes too much of information can result in big confusion. End of the day, a normal trader is getting lost in ocean of data analysis. Every trader is looking for some guidance from leaders like you. Suggest that you may provide your view and analysis from short term, medium term and long term perspective to keep things simple and crystal clear. Please do not mistake me for my suggestions. You are doing great job. You are doing a great service without any doubt. Keep up the good job.

Dear Chetan,

Traders who want ready made food and skip all the analysis and go to bottom of the post and trade on levels mentioned.

Trades who want to be independant and learn the art can go through all the charts and understand who TA can help in taking a trade with proper risk to reward ratio.

Try to learn the process and trading life will be much easier.

Rgds,

Bramesh

Amazing analysis thank you. My view is that RBI rate cuts are bad for the Rupee and Rupee weakness is band for the banking sector. So possible underperformance of the bank nifty is likely post the RBI rate cut on Tuesday.

Thanks for ur view

4 march was the reversal day 9116 so this time 3 June could be 8600++ as top and fall just a view…