- FII’s sold 15.7 K contract of Index Future worth 208 cores, 8.1 K Long contract were squared off by FII’s and 7.6 K short contracts were added by FII’s. Net Open Interest decreased by460 contract , so FII have slowly started shorts in Index Futures and booked profit in long contract.

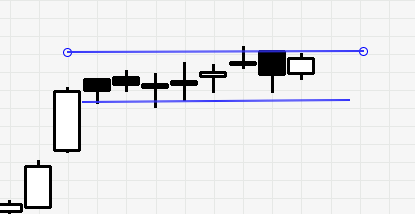

- Nifty move pf past 8 trading session is shown below, range bound move in 125 point range with range contraction suggesting next week will lead to range expansion , On Upside if 8411 is broken 8450 is Fibonacci resistance, Any break below 8320/8280 will see Nifty correcting till 8200/8220 odd levels.FII have slowly started exited long position signalling distribution at top end of range,but break below 8290 is very essential for a small correction of 200/250 points which will be very good for next up move. The upmove is already done 704 points so caution advised on longs but shorts should be below 8290 only.

- Nifty Future November Open Interest Volume is at 2.28 core with liquidation of 2.5 lakh in OI suggesting long liquidation

- Total Future & Option trading volume was at 1.80 lakh core with total contract traded at 2.7 lakh. PCR @1.08, PCR is again showing overconfidence in Bulls.

- 8500 CE OI at 55.4 lakh suggesting wall of resistance , 8400 CE saw 2.6 lakh liquidation in OI suggesting bears are weakening at 8400 but still not down and out. FII’s bought 17 K CE longs and 375 CE were shorted by them.

- 8300 PE OI@ 59.1 lakhs so strong base @ 8300 . 8400 PE added 3.1 lakh in OI so 8400 so option table turned completely in favor of Bulls with rise of 40 points suggesting this range bound move can turn anyside in next 2 days , FII’s bought 50 K contract PE longs and 37.2 K PE were shorted by them. Highest PE addition in this series.

- FII’s bought 645 cores in Equity and DII sold 517 cores in cash segment.INR closed at 61.56.

- Nifty Futures Trend Deciding level is 8401 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8359 and BNF Trend Deciding Level 17609 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17344.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8411 Tgt 8432,8465 and 8490(Nifty Spot Levels)

Sell below 8378 Tgt 8357,8325 and 8300(Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hi Bramesh,

Nice to see you have resources to find FIIs FNO buying and selling figures of Nifty that can help to determine short term trend. So, Nifty read to break 8290-8450 range for further move according to your Fibonacci support and resistance and also cautions as higher levels as Nifty already moved 700 plus points with any reasonable correction. This concludes that Selling at higher levels with stop loss would be the safe strategy.

I am confused, is there any correlation between TD,TC level and BUY SELL tips given in the every days blog. Because when I have to take trade in TD level or take position in TD trigger then what is the use of BUY SELL tips? Please do clear my confusion.

Please read How to trade based on TD/TC levels as mentioned in above post.

Rgds,

Bramesh

thank you