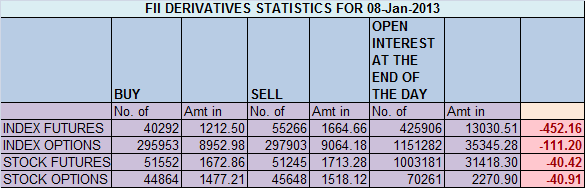

- FIIs sold 14974 contracts of Index Future worth 452 cores (11536 Longs were squared off and 3438 shorts were added) with net Open Interest decreasing by 8098 contracts, so FII’s are covering their long and adding few shorts.

- Nifty closed below its 50 SMA and Bank Nifty below its 200 DMA, which is bearish for market in short term. Nifty has touched the low of Fibo Fan signalling if 6140 is not broken we can see a sharp bounce back. Also as discussed in time analysis 9 Jan +- 1 day will be a range expansion day so Friday get ready for a sharp move in market, once Infy results are out. Nifty hs moved just 80 points in last 4 trading session and we can expect a range expansion.Weekly closing tomorrow. Bulls will like to protect 6155 and bears would like to close nifty below 6100.

- Nifty Future January Open Interest Volume is at 1.70 cores with liquidation of 1.9 lakhs in Open Interest,with reduction in cost of carry signalling long liquidation.

- Total Future & Option trading volume at 1.08 lakh with total contract traded at 1.7 lakh .PCR (Put to Call Ratio) at 0.92.

- 6300 Nifty CE is having highest OI at 50.9 lakhs , remain resistance for the series. 6400 CE added 1.3 lakh and 6200 CE added 6.4 lakhs signalling call writers are increasing position in 6200 CE, today also any move above 6200 NF was getting sold into. 6000-6500 CE liquidated 8.4 Lakh in OI.FII’s sold 16 K contracts of CE.

- 6000 PE is having highest OI at 54.3 lakhs suggesting strong support at 6000,6100 PE added 1.9 lakh 6200 PE liquidated 0.8 lakh suggesting PE writers who added position yesterday liquidated the same.Another 7 Lakh PE added in 5700-6000 strike price signalling OTM calls are still seeing long addition, 6000-6500 PE added 4.6 Lakh in OI. FII’s for 5 day in row added in PE, total 1.2 lakh contracts have been added in 5 days mostly in 5900 and 6000 PE.

- FIIs sold 3.74 cores in Equity ,and DII sold 118 cores in cash segment.INR closed at 62.07.The effect of Fed tapering is visible as FII just bought 577 cores in 10 trading days.

- Nifty Futures Trend Deciding level is 6182 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6285 and BNF Trend Changer Level (Positional Traders) 11321.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6176 Tgt 6200,6222 and 6253 (Nifty Spot Levels)

Sell below 6145 Tgt 6131 ,6120 and 6091 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

Your way of telling the whole thing in this paragraph

is truly nice, all can effortlessly be aware of it, Thanks a lot.

Sir,

What An excellent analysis you have done…..

Thanks for sharing your view… 🙂

Sir my question is how do you calculate those nifty levels of buy above and sell below ?….