- FIIs bought 10918 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 325 cores with net Open Interest increasing by 39232 contracts, so again long addition by FII. Want to be Successful Trader ?

- Today was the taxing day for traders as Nifty kept swinging between positive and negative terrain. Traders following Quadrant System must have made money, but positional traders following SAR and Trend Changer level must have hard time as both side Stop loss were triggered. Well let me reiterate this is part and parcel of trading and just have trust and discipline on system and one right move by market will wipe of all losses. Nifty formed an DOJI candlestick pattern near the crucial level of 6000 suggesting confusion in market participants. Nifty will make a decisive move by friday and resolve the mystery.

- Nifty Future May Open Interest Volume is at 2.25 cores with addition of 2.3 lakh in Open Interest with increase in Cost of Carry of Nifty Future to showing traders are initiating fresh long position .

- Total Future & Option trading volume at 1.34 lakh with total contract traded at 2.24 lakh , PCR (Put to Call Ratio) at 0.97.

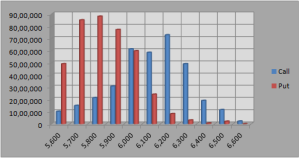

- 6200 Nifty CE is having highest OI at 72.8 lakhs with liquidation of 5.7 lakhs in OI ,6100 remains the wall of resistance and 6000 remains the fighting zone between bulls and bears as OI is at 61.3 lakhs .5700-6300 CE liquidated 2.5 Lakhs in OI.

- 5800 Put Option is having highest Open Interest of 88.1 lakhs with addition of 2 lakhs in OI ,5900 PE added 11.2 lakhs and net OI at 77.2 lakhs,suggesting put writers are again back in action, 6000 PE added 0.5 lakhs, suggesting confusion at 6000 Strike price which should be resolved soon.5700-6300 CE added 8.5 Lakhs in OI

- FIIs bought in Equity in tune of 421 cores,and DII sold 412 cores in cash segment ,INR closed at 54.10 Live INR Chart for market hours and currency traders

- Nifty Futures Trend Deciding level is 6026 (For Intraday Traders).Nifty Trend Changer Level 5997 and Bank Nifty Trend Changer level 12546.

Buy above 6000 Tgt 6023,6050 and 6072(Nifty Spot Levels)

Sell below 5970 Tgt 5950,5930 and 5910(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863