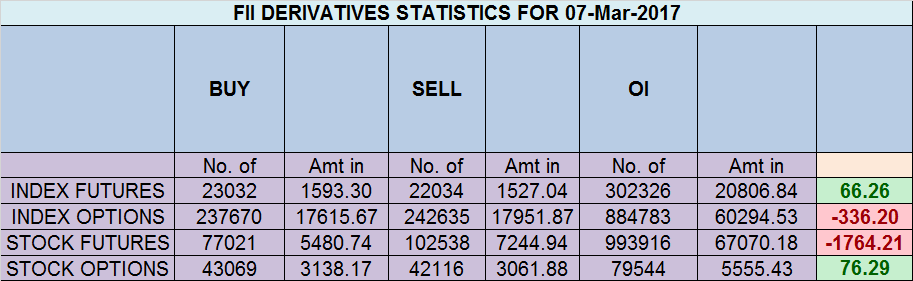

- FII’s bought 998 contract of Index Future worth 66 cores , 14 K Long contract were added by FII’s and 13 K short contracts were added by FII’s. Net Open Interest increased by 27.1 K contract, so fall in market was used by FII’s to enter long and enter short in Index futures. How Ordinary People Became Millionaire Traders

- As discussed in last analysis Breakout above 8996 and breakdown below 8850 in between buy low sell high should be trading strategy or avoid trading if you do not like choppy moves. Nifty formed an NR7 pattern today and continue to trade near the gann angles. Accept a good move in next 2 trading sessions, Breakout above 8995 for a move towards 9080. Breakdown below 8850 for a move towards 8780/8700. Bank Nifty forms Inside Day Pattern,EOD Analysis

- Nifty March Future Open Interest Volume is at 2.18 core with addition of 2.2 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @8925 closed above it.

- Total Future & Option trading volume at 2.22 Lakh core with total contract traded at 0.59 lakh , PCR @0.85

- 9000 CE is having Highest OI at 54.3 lakh, resistance at 9000 followed by 8900 .8500-9000 CE added 0.70 Lakh in OI so bears covered in 8800/8700 CE .FII bought 2.7 K CE longs and 3.7 K CE were shorted by them .Retail bought 35 K CE contracts and 20 K CE were shorted by them.

- 8800 PE OI@41.7 lakhs having the highest OI strong support at 8800 followed by 8700. 8500-9000 PE added 6.6 Lakh in OI so bulls added in 8700/8800 PE. FII bought 10 K PE and 20.3 K PE were shorted by them .Retail bought 10 K PE contracts and 20.3 K PE were shorted by them.

- FII’s bought 920 cores in Equity and DII’s sold 1073 cores in cash segment.INR closed at 66.67

- Nifty Futures Trend Deciding level is 8971 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8948. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8955 Tgt 8972,8995 and 9020 (Nifty Spot Levels)

Sell below 8920 Tgt 8900,8881 and 8850 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh