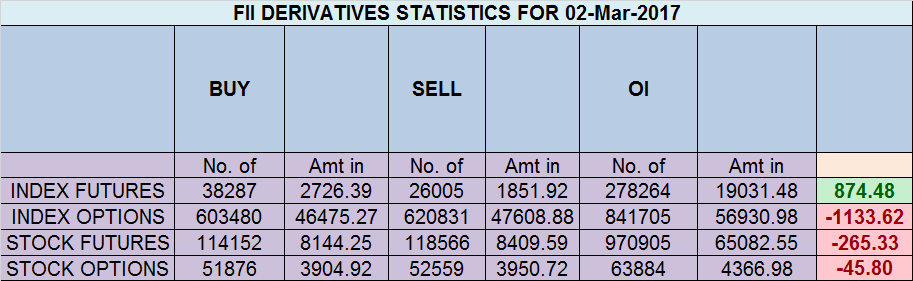

- FII’s bought 12.2 K contract of Index Future worth 874 cores , 3.7 K Long contract were added by FII’s and 8.5 K short contracts were added by FII’s. Net Open Interest decreased by 4.7 K contract, so fall in market was used by FII’s to enter long and exit short in Index futures. Learn from Your Trading Mistakes

- As discussed in last analysis Bulls need a fresh close above 8989 for a move towards 9083 which should be very fast. Bearish only on break of 8850.As per our time cycle we got the trending move. High made today was 8992 nifty was unable to sustain above 8989 which is gann angle resistance and gave the fall back to lower end of gann angle as shown in below chart, From 1 gann angle to another gann angel, we are technically trapped in the range between 2 gann angles, Buy Support Sell resistance will be the best strategy till we see breakdown below 8850 or breakout above 8989. Bank Nifty does 20500,another failed attempt at gann arc,EOD Analysis

- Nifty March Future Open Interest Volume is at 2.21 core with liquidation of 3.3 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @8925 closed below it.

- Total Future & Option trading volume at 7.1 Lakh core with total contract traded at 1.46 lakh , PCR @0.92

- 9000 CE is having Highest OI at 51.2 lakh, resistance at 9000 followed by 8900 .8500-9000 CE added 6.8 Lakh in OI so bears added in 8900/9000 CE .FII bought 3.3 K CE longs and 7.4 K CE were shorted by them .Retail sold 35.9 K CE contracts and 41.6 K shorted CE were covered by them.

- 8800 PE OI@40.5 lakhs having the highest OI strong support at 8800 followed by 8700. 8500-9000 PE added 4.9 Lakh in OI so bulls added in 8700/8800 PE. FII bought 1.9 K PE and 15.1 K PE were shorted by them .Retail sold 65.4 K PE contracts and 45.4 K shorted PE were covered by them.

- FII’s bought 122 cores in Equity and DII’s sold 83 cores in cash segment.INR closed at 66.71

- Nifty Futures Trend Deciding level is 8970 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8950 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8925 Tgt 8948,8968 and 9000 (Nifty Spot Levels)

Sell below 8865 Tgt 8850,8830 and 8810 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Sir perhaps selling rates are wrongly typed