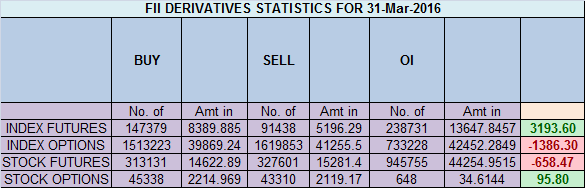

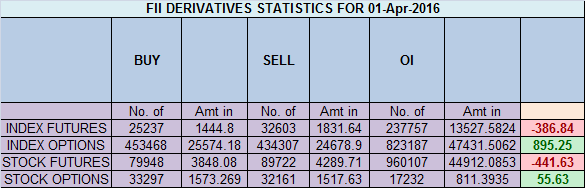

- FII’s sold 7.3 K contract of Index Future worth 386 cores ,4.1 K Long contract were liquidated by FII’s and 3.1 K short contracts were added by FII’s. Net Open Interest decreased by 0.9 K contract, so fall in Nifty market was used by FII’s to exit long and enter shorts in Index futures.Which type of a trader are you?

- Nifty after turning from the butterfly PRZ zone and also made high near the gann arc, suggesting resistance will be strong as its confluence of different studies is happening,As per gann analysis 7741 will play crucial role in April series,Closing above it nifty can move towards 7968 below it 7519 is on cards. Bank Nifty in consolidation mode,EOD Analysis

- Nifty April Future Open Interest Volume is at 1.85 core with liquidation of 3.5 Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @7740.

- Total Future & Option trading volume was at 1.74 Lakh core with total contract traded at 1.8 lakh , PCR @1.11, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 55.8 lakh, resistance at 8000 .7500/8000 CE added 20 lakh so bears added in range of 7900/8000 .FII bought 3 K CE longs and 26.8 K CE were shorted by them .Retail bought 37 K CE contracts and 6.8 K CE were shorted by them.

- 7500 PE OI@44 lakhs having the highest OI strong support at 7500. 7000-7600 PE added 58.1 Lakh in OI so strong base near 7500/7400 .FII bought 51 K PE longs and 8.5 K PE were shorted by them .Retail bought 28.3 K PE contracts and 30.8 K PE were shorted by them.

- FII’s bought 241 cores in Equity and DII’s sold 520 cores in cash segment.INR closed at 66.24

- Nifty Futures Trend Deciding level is 7738 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7764 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7742 Tgt 7770,7803 and 7850 (Nifty Spot Levels)

Sell below 7700 Tgt 7672,7645 and 7610 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-140117182685863/

FII bought 51 K PE longs and 8.5 K PE were shorted by them.

Bramesh ji, is it 51k or 5.1k?

Dear Abhayji,

Its 51 K

The effect showed today. All thanks to your analysis! Thank you.

Please answer first comment….I have the same question.

Please read this http://www.brameshtechanalysis.com/2013/09/nifty-futures-positional-strategy/

Thank you very much Bramesh…

Dear Brahmesh,

Nifty Futures Trend Deciding Level = 7764 ( Positional )

I would like to know if this gets crossed in day and sustains for more than 10 minutes shall we create long term positions and buy nifty futures?

How this exactly works?

I have read the article but still a bit unclear.

Please read this clearly mentioned

http://www.brameshtechanalysis.com/2013/09/nifty-futures-positional-strategy/

Sir where to find how much ces pes bought shorted by fii dii or retailers?? Can u plz share the link

Sir plz ans my query if possible…it would be a great help…

Its done based on an excel program i have developed.

everything is in nse website..