FII & Client Activity – Nifty Index Futures | 04 June 2025

Foreign Institutional Investors (FIIs) showed a neutral stance in the Nifty Index Futures market on 04 June 2025, with moderate buying accompanied by a similar build-up in short positions. This suggests a hedged or cautious outlook amid ongoing uncertainty.

Key Data Snapshot

-

Contracts Bought: 1,141

-

Notional Value: ₹209 crore

-

Net Open Interest (OI) Change: +1,237 contracts

Breaking Down FII Activity

-

✅ Long Contracts Added: 1,138

-

✅ Short Contracts Added: 919

-

FII Long-to-Short Ratio: 0.20

-

FII Positioning: 17% Long | 83% Short

The extremely low long-to-short ratio underscores that while fresh longs are being added, FIIs remain heavily short-biased and are possibly using longs as hedges in a volatile environment.

Client Behavior Overview

-

✅ Long Contracts Added: 3,462

-

✅ Short Contracts Added: 4,216

-

Client Long-to-Short Ratio: 1.59

-

Client Positioning: 61% Long | 39% Short

Retail and domestic institutional clients continued to display bullish sentiment, building long positions aggressively. However, the simultaneous addition of shorts indicates a more balanced or tactical approach, possibly to hedge existing exposures.

Key Takeaways

-

FII Activity: Reflects a neutral-to-cautious stance with limited directional commitment but heavy net short bias still intact.

-

Client Behavior: Clients remain net bullish, expecting further upside, likely supported by domestic liquidity and technical strength.

June 05, 2025 Nifty Expiry: Must-Watch Options Trading Levels

You can read the Previous Day Analysis by clicking on this link.

Nifty traded in a narrow range today, forming an Inside Bar on the daily chart — a classic sign of consolidation and potential buildup ahead of a key trigger. With the RBI Monetary Policy announcement on the horizon, today’s session reflected a “calm before the storm” setup.

Key Technical Observations

-

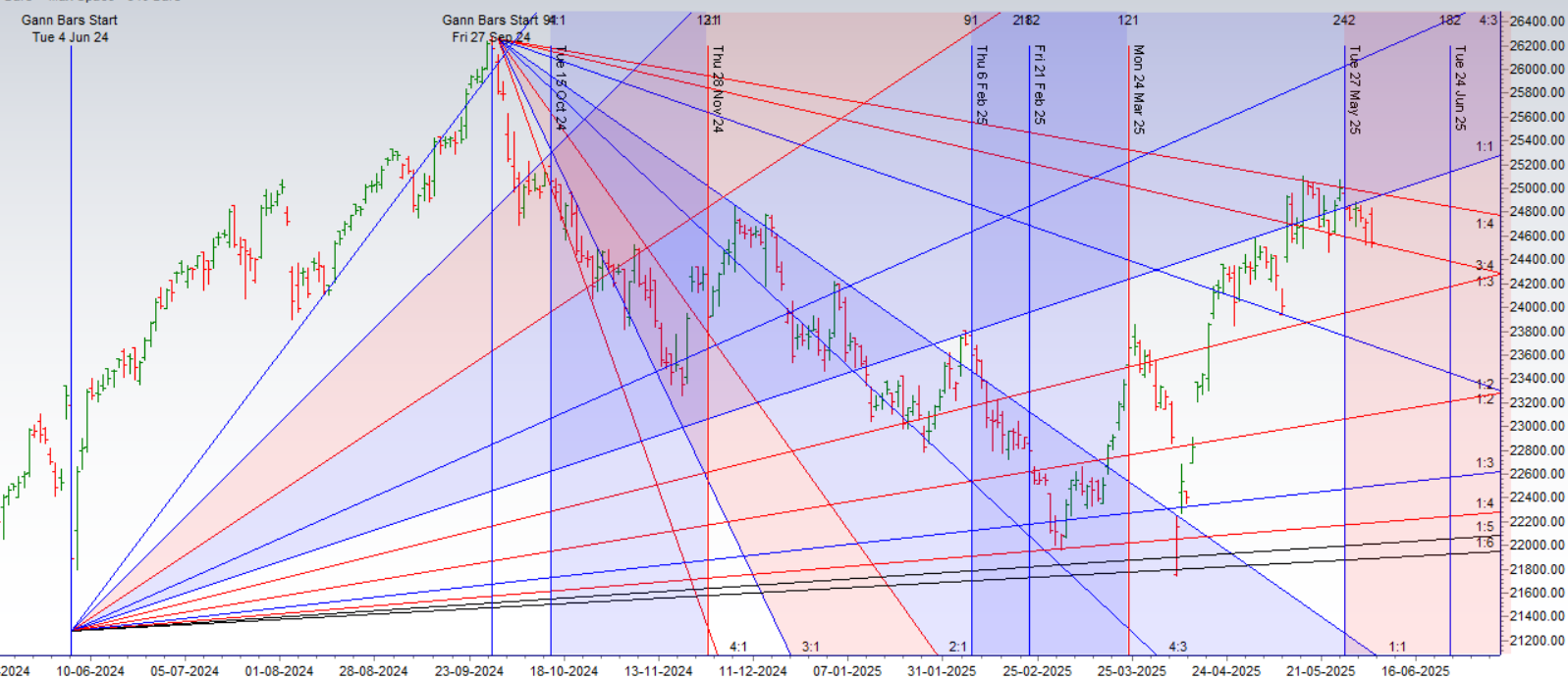

Gann Support: Nifty once again took support at the 3×4 Gann angle, reinforcing the significance of this trend level.

-

Critical Zone: The index continues to defend the 24,500 mark, which has acted as a pivotal support zone over the last few sessions.

-

Range Compression: The inside bar formation is a clear indicator of price compression. Expect a strong directional move once the range is broken.

Breakout Levels to Watch

-

Bullish Trigger: Above 24,762

A close above this level could ignite bullish momentum, targeting 24,889 and then 25,000 psychological resistance. -

Bearish Trigger: Below 24,500

A breakdown below this level may invite swift selling pressure, with immediate targets at 24,389 and potentially lower.

Strategic Takeaway

With the RBI policy decision just around the corner, traders should:

-

Avoid aggressive positioning until a clear breakout occurs.

-

Be prepared for volatility spikes — particularly in rate-sensitive sectors like Banking, Auto, and Realty.

This is a classic setup where Price + Time + Event converge — stay nimble and react to price action.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24640 for a move towards 24799/24957 Bears will get active below 24482 for a move towards 24323/24165

Traders may watch out for potential intraday reversals at 09:31,10:27,11:50,01:38,02:38 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.24 lakh cr , witnessing liquidation of 2.3 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was covering of SHORT positions today.

Nifty Advance Decline Ratio at 32:18 and Nifty Rollover Cost is @24321 closed above it.

Nifty Gann Monthly Trade level :24211 closed above it

Nifty has closed Below its 20 SMA @ 24724 Trend is Sell on Rise till below 24724

Nifty options chain shows that the maximum pain point is at 24600 and the put-call ratio (PCR) is at 0.64.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24600 strike, followed by 24700 strikes. On the put side, the highest OI is at the 24500 strike, followed by 24400 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24400-24800 levels.

Retail & FII Options Market Activity – 04 June 2025

Understanding daily positioning in the options market helps decode market sentiment and spot early signs of directional bias. Here’s the breakdown of Retail and Foreign Institutional Investors (FIIs) activity on 04 June 2025:

Retail Activity Overview

Call Options

-

Covered: 724 contracts

-

Shorted: 35,000 contracts

Indicates mild profit booking in existing longs and a cautious or neutral stance via aggressive call writing.

Put Options

-

Added: 262,000 contracts

-

Shorted: 194,000 contracts

⚖️ Mixed activity suggests protective put buying alongside shorting, signaling neutral-to-bearish hedging behavior.

Retail Sentiment: Slightly defensive. While put writing suggests confidence in downside protection, put additions show risk-averse hedging. Heavy call writing reflects limited upside expectations in the short term.

FII Activity Overview

Call Options

-

Covered: 29,900 contracts

-

Shorted: 128 contracts

FIIs trimmed long call exposure while maintaining minimal new shorts — a sign of reduced bullish momentum without taking outright negative bets.

Put Options

-

Covered: 21,700 contracts

-

Shorted: 44,000 contracts

FIIs reduced protection and increased put writing, often viewed as a bullish undertone, betting on support holding at current levels.

FII Sentiment: Neutral-to-positive, with cautious unwinding of downside hedges and maintaining a base case of limited downside risk.

Interpretation & Market Read

-

-

-

Retail: Preparing for volatility; uncertain about direction.

-

FIIs: Reducing risk and leaning slightly bullish, despite index future data reflecting broader short bias.

-

Overall Market Outlook: Expect rangebound action in the near term with a possible directional breakout

-

-

In the cash segment, Foreign Institutional Investors (FII) bought 5907 cr , while Domestic Institutional Investors (DII) bought 5907 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Those who succeed big at anything all have the same attitude: You keep going until it happens or you die trying. Quitting is not an option.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 799 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24707 , Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 24823

Lower End of Expiry : 24417

Nifty Intraday Trading Levels

Buy Above 24658 Tgt 24699, 24729 and 24785 ( Nifty Spot Levels)

Sell Below 24600 Tgt 24555, 24512 and 24470 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators