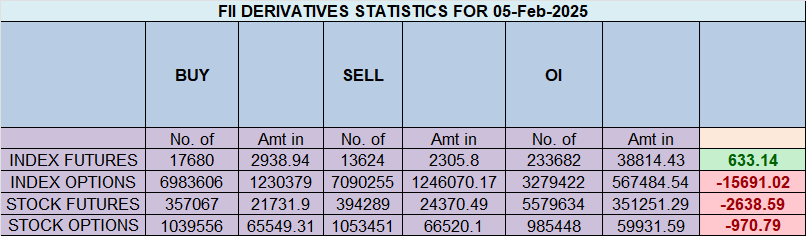

FII Activity: Bullish Sentiment in Nifty Index Futures

Foreign Institutional Investors (FIIs) continue to show a bullish outlook in the Nifty Index Futures market, actively buying 672 contracts worth ₹20 crore. This activity led to a minor increase of 2,360 contracts in net open interest, indicating fresh positions being built.

Breaking Down FII Activity

- FIIs added 3,467 long contracts, increasing their bullish exposure.

- FIIs covered 589 short contracts, reducing their bearish bets.

Client Behavior

- Clients covered 1,115 long contracts, suggesting profit booking or reduced bullish conviction.

- Clients added 431 short contracts, indicating mild bearish positioning.

Current Positioning in Index Futures

- FIIs: Holding 18% long and 82% short positions → While they are adding longs, the overall bias remains bearish.

- Clients: Holding 71% long and 29% short positions → Clients continue to maintain a bullish stance.

Market Outlook & Key Takeaways

✔ FIIs increasing long positions while covering shorts could indicate early signs of a shift in sentiment.

✔ However, with 82% of FII positions still short, a clear bullish breakout is yet to be confirmed.

✔ Clients remain optimistic, suggesting that the broader market still has bullish momentum.

✔ Key trigger points—if Nifty sustains above resistance levels, we could see further short-covering rallies.

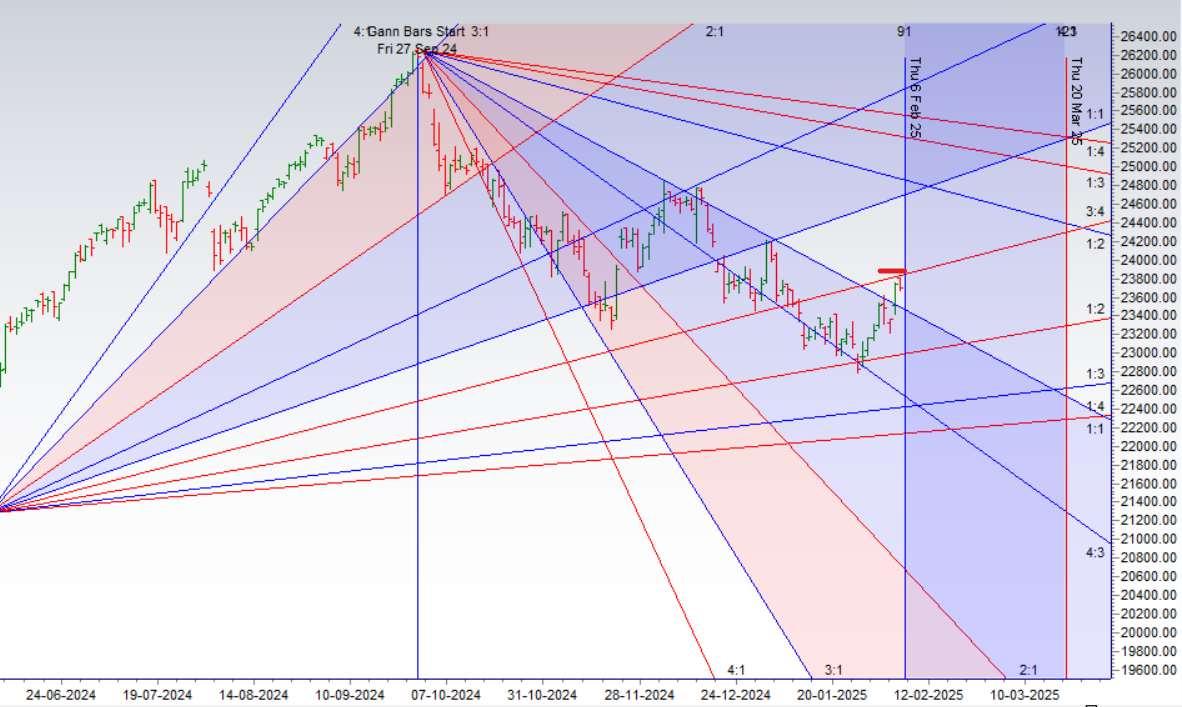

Nifty reacted strongly to the Venus Ingress and Jupiter turning direct, triggering a breakout once the price closed above the 23,521–23,533 range. The Sensex expiry further accelerated momentum, pushing Nifty higher.

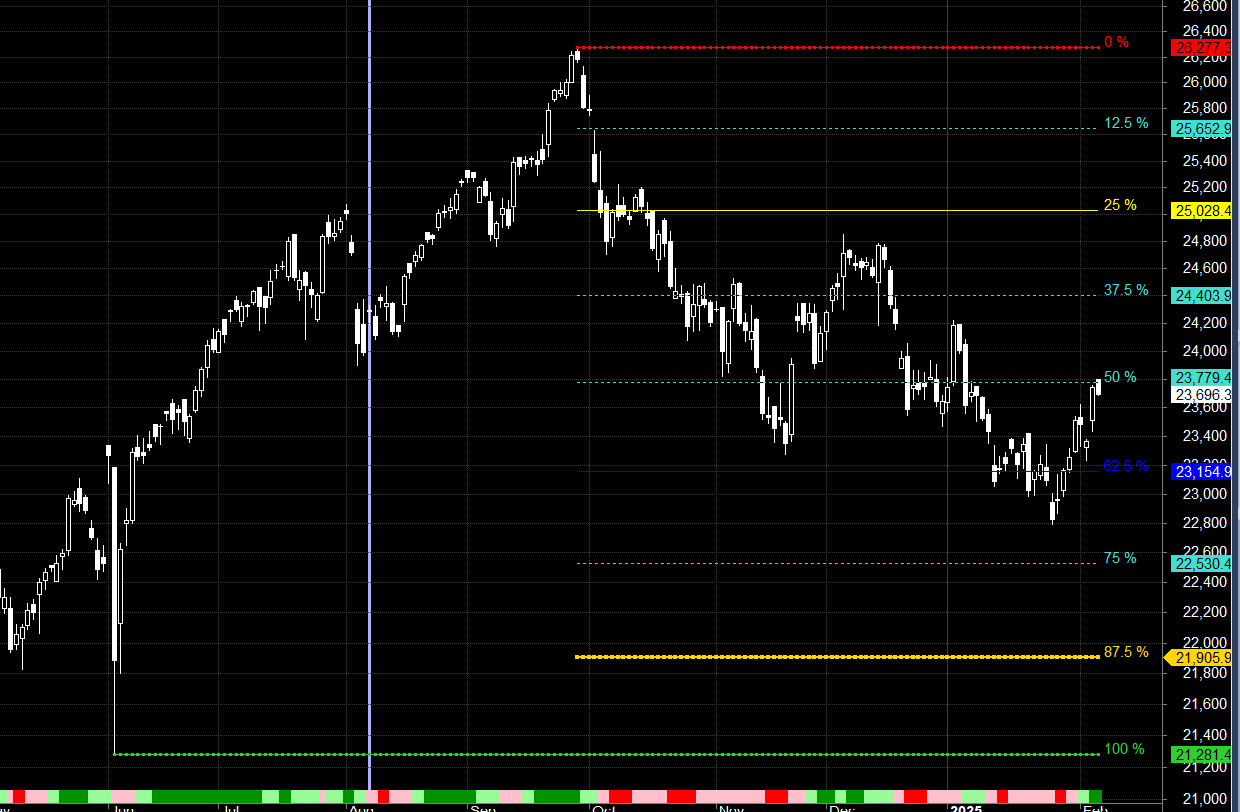

Key Resistance & Support Levels

- Supply Zone: 23,779–23,822 → Bulls need to clear this level to drive Nifty towards 24,000.

- Support Zone: 23,700 → If Nifty breaks below this level, bears will regain control, potentially leading to further downside.

Market Outlook

- A sustained move above 23,822 could trigger a rally towards 24,000.

- A break below 23,700 may bring in selling pressure, leading to a retracement.

- Astro & Gann cycles continue to align, signaling increased volatility in the coming sessions

Nifty formed a bearish candle at the Octave Point of 23,779, facing precise resistance at the Gann angle (23,779–23,822). This zone has emerged as a key supply area, limiting further upside.

Adding to this, Nifty has completed 90 days from the September 26, 2024 top, creating a strong confluence of Gann price & time cycles. With the RBI policy announcement approaching, the market is setting up for a potentially big move.

Tomorrow’s weekly expiry further amplifies the chances of high volatility, making it a day for traders to stay alert.

Key Resistance & Support Levels

Supply Zone: 23,779–23,822 → Bulls must break and sustain above this zone to push Nifty towards 24,000.

Support Zone: 23,700 → A breakdown below this level could trigger further downside, shifting momentum in favor of bears.

Market Outlook & Trading Strategy

- A breakout above 23,822 could fuel a rally towards 24,000.

- A breakdown below 23,700 could invite sharp selling pressure.

- With weekly expiry and RBI policy ahead, expect large swings and sudden reversals.

Traders should manage risk carefully and stay prepared for a volatile session!

Nifty Trade Plan for Positional Trade ,Bulls will get active above 23805 for a move towards 23882/23958/24035. Bears will get active below 23652 for a move towards 23576/23499/23423

Traders may watch out for potential intraday reversals at 09:23,10:54,12:45,01:34,02:25 How to Find and Trade Intraday Reversal Times

Nifty December Futures Open Interest Volume stood at 1.66 lakh cr , witnessing liquidation of 4.2 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was covering of SHORT positions today.

Nifty Advance Decline Ratio at 22:27 and Nifty Rollover Cost is @23879 closed below it.

Nifty Gann Monthly Trade level :23721 closed above it.

Nifty has closed above its 20 SMA @ 23274 Trend has changed to Buy on Dips once above 23400.

Nifty options chain shows that the maximum pain point is at 23800 and the put-call ratio (PCR) is at 1.05 .Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 23800 strike, followed by 24000 strikes. On the put side, the highest OI is at the 23600 strike, followed by 23500 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 23500-24000 levels.

Retail & FII Activity in the Options Market – Key Insights

Understanding retail and FII positioning in the options market provides valuable clues about market sentiment and potential moves. Here’s a breakdown of today’s activity:

Retail Activity in Options Market

Retail traders displayed mixed sentiment, with a higher emphasis on call buying while maintaining a balanced put position.

Call Options:

- Added 510K contracts, indicating bullish bets.

- Shorted 388K contracts, suggesting expectations of limited upside.

Put Options:

- Added 48K contracts, a slight hedge against downside risks.

- Shorted 50K contracts, suggesting traders expect strong support levels to hold.

Retail Takeaway: Retail traders appear moderately bullish, as they are aggressively buying calls while also shorting puts—a sign that they expect limited downside risk.

FII Activity in Options Market

FIIs continue to maintain a cautious stance, with a slight bearish bias in call options and mixed put positioning.

Call Options:

- Added 71.5K contracts, showing some bullish interest.

- Shorted 123K contracts, indicating strong resistance at higher levels.

Put Options:

- Added 61K contracts, hedging against possible downside.

- Shorted 111K contracts, reducing bearish exposure.

FII Takeaway:

FIIs are adding calls but shorting them at a higher rate, suggesting they expect resistance at higher levels. The heavy put shorting indicates a lack of conviction in a major down move, aligning with a neutral-to-slightly-bullish bias.

Market Outlook & Key Takeaways

✔ Retail traders are aggressively buying calls, signaling bullish expectations.

✔ FIIs remain cautious, selling calls and shorting puts, indicating potential resistance ahead.

✔ With significant put shorting, a strong upside move could force unwinding, fueling a rally.

✔ The key battle between bulls and bears will play out at crucial resistance levels.

In the cash segment, Foreign Institutional Investors (FII) sold 1682 Cr , while Domestic Institutional Investors (DII) bought 996 cr

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 22751-23408-24105-24801 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

“I do not believe in gambling or reckless speculation, but am firmly convinced, after years of experience, that if traders will follow rules and trade on definite indications, that speculation can be made a profitable profession” W D Gann

For Positional Traders, The Nifty Futures’ Trend Change Level is At 23559. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 23813, Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 23871

Lower End of Expiry : 23521

Nifty Intraday Trading Levels

Buy Above 23712 Tgt 23743, 23777 and 23816 ( Nifty Spot Levels)

Sell Below 23666 Tgt 23630, 23600 and 23555 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators