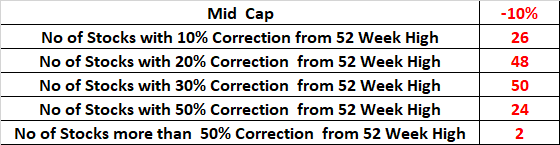

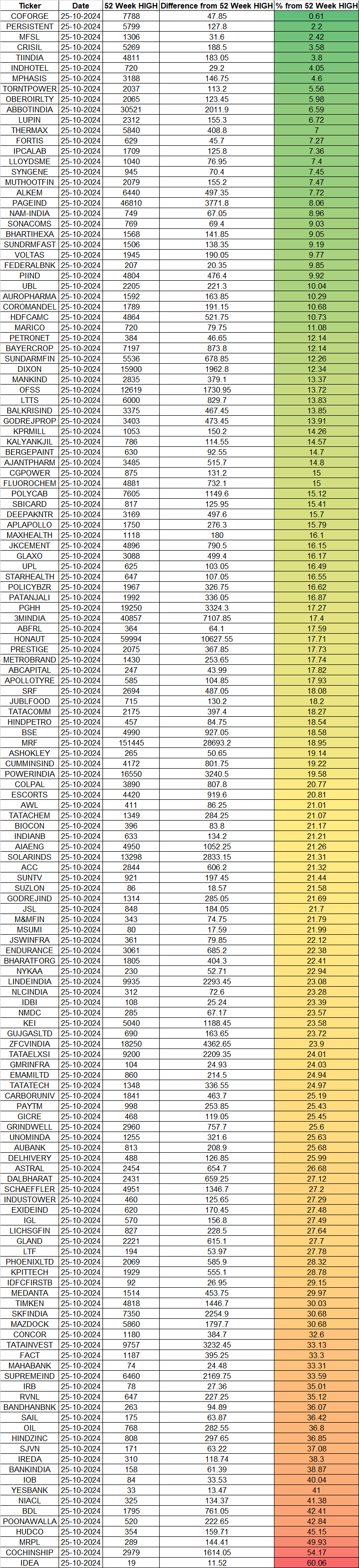

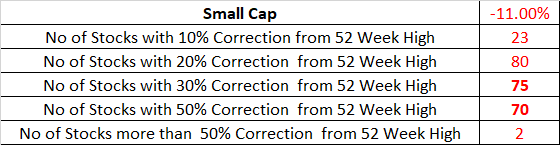

The Nifty Midcap and Small Cap index has dropped close to 10-11 % from its record high of 60,924, which it reached on September 24 of this year. Since that peak, the index has been in a corrective phase.

Notably, nearly 2,000 points of the total 4,500-point decline from the peak occurred within the last two trading sessions alone.

Since the September 24 high, only 20 of the 100 Nifty Midcap constituents have managed to post positive returns, while the remaining 80 have recorded negative returns.

The “52-week high effect” suggests that stocks near their 52-week highs have better subsequent returns than those far from their 52-week highs. Investors use the 52-week high as a benchmark against which to value stocks. When a stock price is near its 52-week high, investors are reluctant to bid the price up to its fundamental value. As a result, they tend to underreact when the stock price approaches the 52-week high, creating the 52-week high effect.