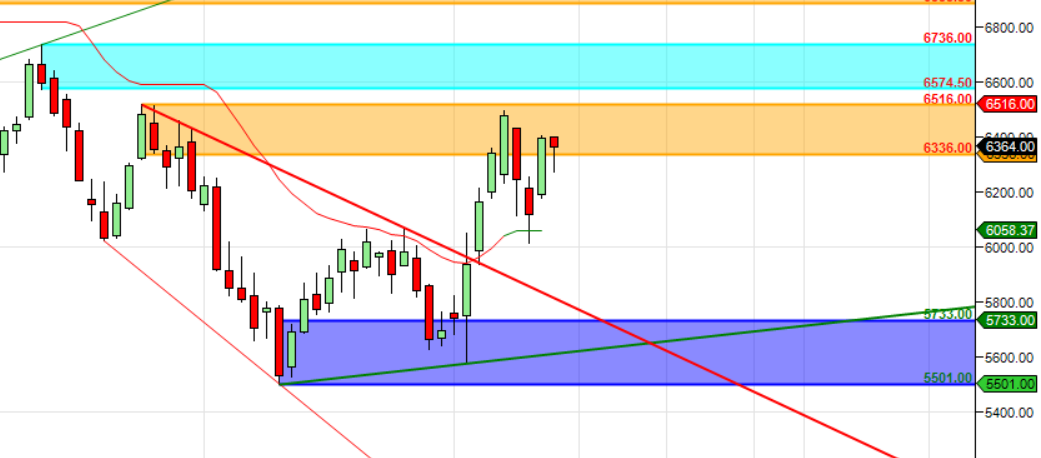

A role reversal has occurred, with previous key resistance now acting as strong support, prompting a price rebound. Implied Volatility (IV) remains elevated at 53-56%, and skews are heavily favoring calls over puts, indicating that the geopolitical risk premium from West Asia is still factored in. The recent price correction has been substantial, suggesting the uptrend could resume. Targets are set at 6,500, followed by 6,800, with positional long stops placed below 6,000. If prices fall and sustain below 6,000, it’s advisable to exit long positions. Given the high volatility and elevated IVs, traders are advised to use call spreads rather than naked futures or single calls to manage risk effectively. For positional traders, the strategy remains to buy on dips until trend changes.

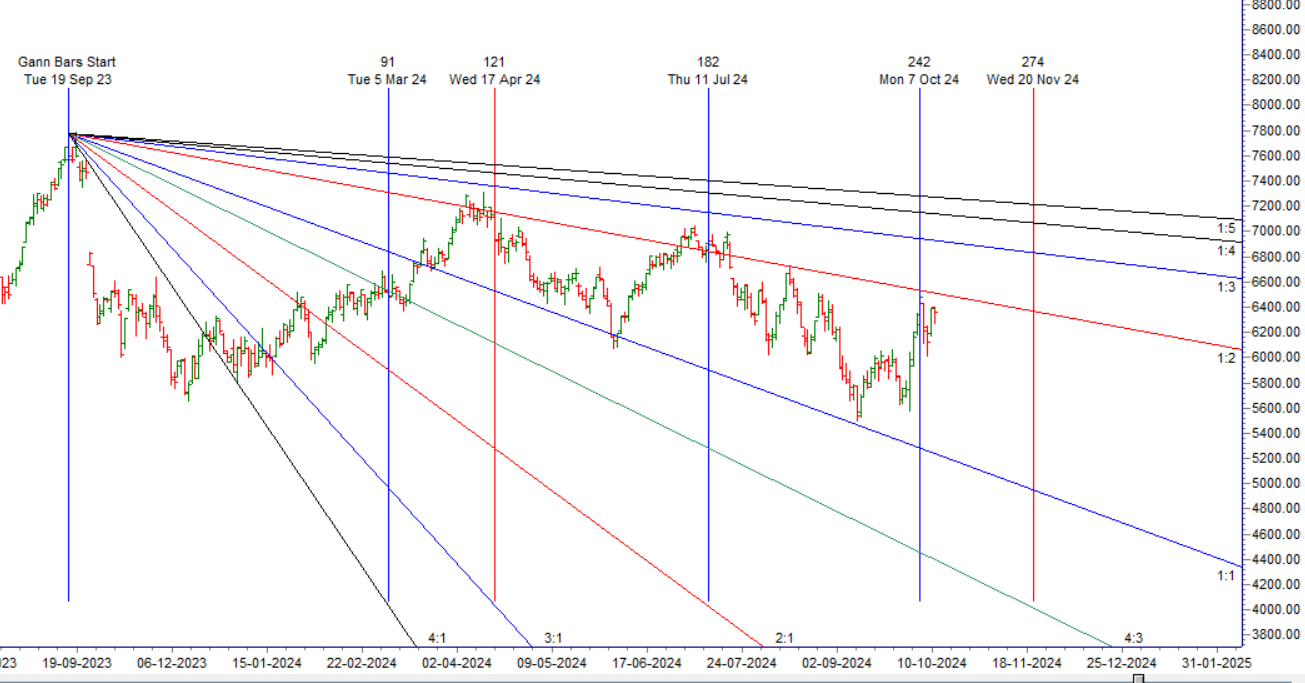

MCX Crude Oil Gann Angle Chart

Crude is near its 100 DMA @6380, Range of 6380-6469 is crucial break of same can lead to rise towards 6666/6882.

MCX Crude Oil Supply Demand Zone

MCX CRUDE OIL Supply Demand Chart : Demand in range of 6200-6160 Supply in range of 6336-6400

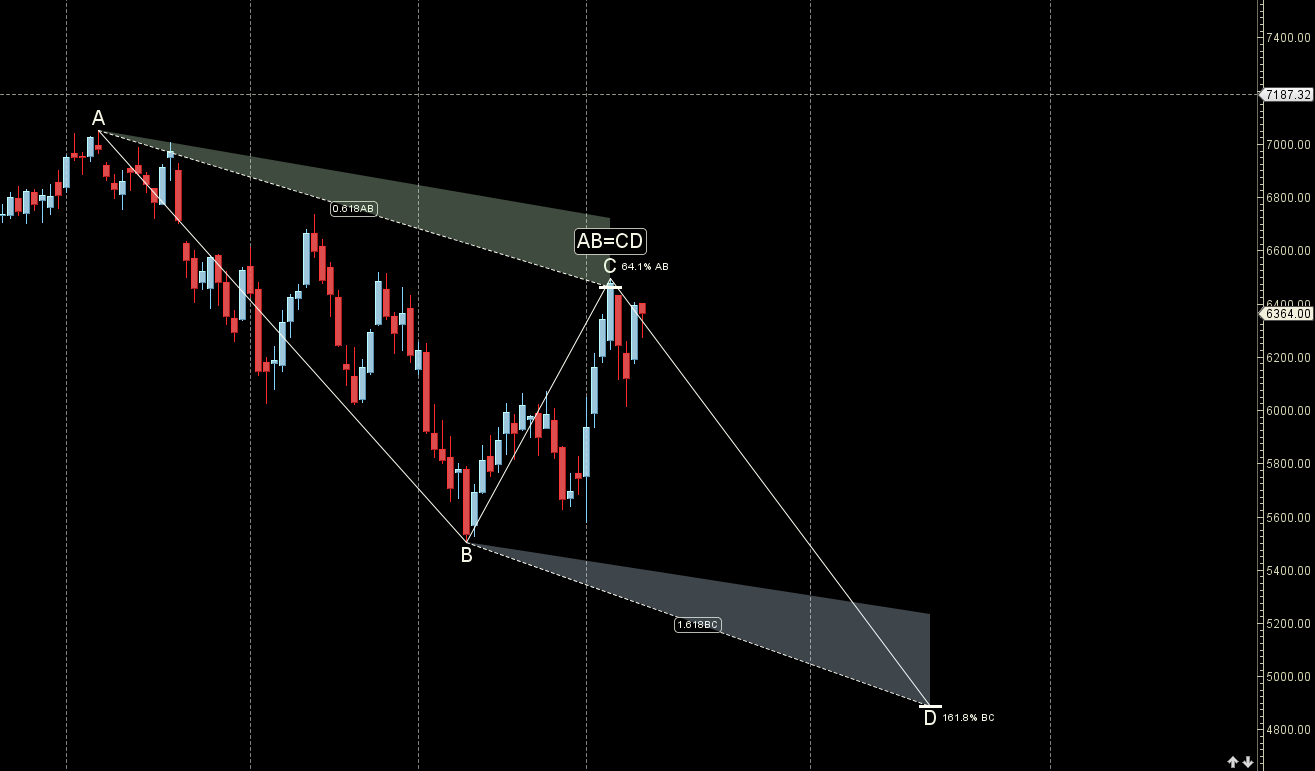

MCX Crude Oil Crude Harmonic

Price is heading towards 6000 once below 6300