Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 400 contracts with a total value of 30 crores. This activity led to a increase of 6810 contracts in the Net Open Interest.

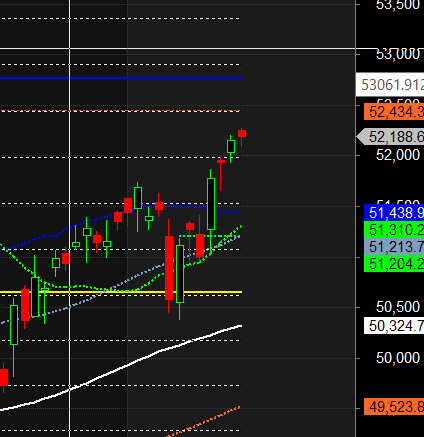

Bank Nifty continued its rally to the upside, closing above its 62.5% retracement @51969. Price till holding 51969 their is high probablity of hitting all time high @53357. It formed an NR7 pattern ahead of the US Fed rate cut decision and one of the most important astrological events of the year, the Lunar Eclipse.

Only below 51506 Bears will get a chance till than Bulls will rule. Trade cautiously, as Lunar Eclipses have historically caused trend reversals.

Bank Nifty formed an NR21 pattern today ahead of the Fed rate cut and multiple lunar dates, with a Lunar Eclipse coming tomorrow, as discussed in the video below. Intraday traders should watch the first 15 minutes’ high and low to capture the trend for the day.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 52380 for a move towards 52606/52832.Bears will get active below 51928 for a move towards 51702/51476

Traders may watch out for potential intraday reversals at 09:57,11:31,12:16,02:13 How to Find and Trade Intraday Reversal Times

Bank Nifty September Futures Open Interest Volume stood at 20.2 lakh, with liquidation of 0.94 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of LONG positions today.

Bank Nifty Advance Decline Ratio at 06:06 and Bank Nifty Rollover Cost is @51260 closed above it.

Bank Nifty Gann Monthly Trade level :51204 closed above it.

Bank Nifty closed above its 50 SMA @51320 Trend is Buy on Dips.

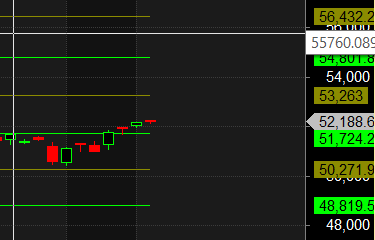

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 52200 strike, followed by the 52500 strike. On the put side, the 52000 strike has the highest OI, followed by the 51500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 50500-51000 range.

The Bank Nifty options chain shows that the maximum pain point is at 52200 and the put-call ratio (PCR) is at 0.88 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

The biggest The trader’s enemy is fear, Fear generates thoughts and Reactions. And these thoughts and reactions cause when trading often behaviour that leads to unsuccessful behaviour. That is why there is fear the greatest hindrance to success in trading.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51591. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 52289 , Which Acts As An Intraday Trend Change Level.

Bank Nifty Expiry Range

Upper End of Expiry : 52531

Lower End of Expiry : 51844

Bank Nifty Intraday Trading Levels

Buy Above 52200 Tgt 52300, 52416 and 52610 ( Bank Nifty Spot Levels)

Sell Below 52108 Tgt 51987, 51888 and 51729 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.