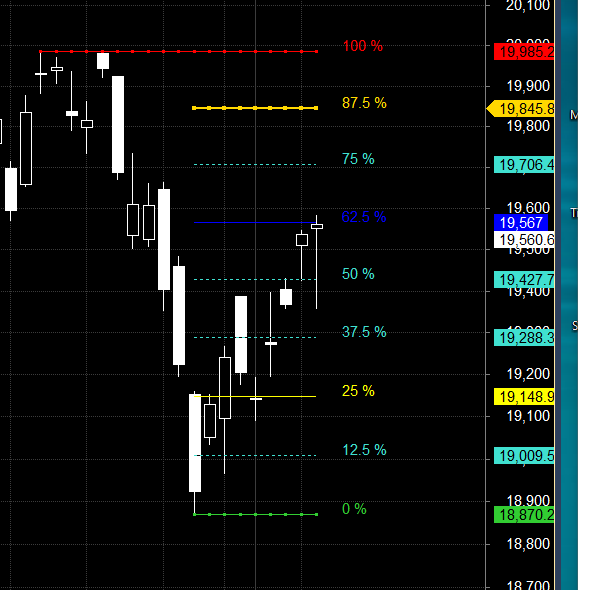

Finance Nifty saw a big gap up today and price is forming higher highs closed above both 200/20 DMA and 50% of the entier fall at 19427 and above gann angle. Till we are above 19427 Bulls are in the control.

Finance Nifty formed an Outside Bar after 4 DOJI and another day closed above Saturn Direct High and 1×2 Gann Angle and 50% point of 19427 . Today we have Venus Ingress so Private Bank ie. ICICI/HDFC should be in focus. Watch for first 15 mins High and Low to capture the trend of the day. Today is the 9 day of rise from the 26 Oct bottom. 9 is important number as per gann so be ready for a volatile move.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 19562 for a move towards 19632/19702. Bears will get active below 19478 for a move towards 19408/19338. — Waiting for 19632/19702

Traders may watch out for potential intraday reversals at 9:28,12:02,2:15 How to Find and Trade Intraday Reversal Times

Finance Nifty Nov Futures Open Interest Volume stood at 52000 with liquidation of 3000 contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Finance Nifty Advance Decline Ratio at 11:09, Finance Nifty Rollover Cost is @19275 closed above it

Finance Nifty has closed above its 20 DMA @19512, Holding 19500 can see rally towards 19666/19729.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 18832-19376-19953 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has taken closed above 19376

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 19550 strike, followed by the 19650 strike. On the put side, the 19450 strike has the highest OI, followed by the 19400 strike. This indicates that market participants anticipate Finance Nifty to stay within the 19500-19600 range.

The Finance Nifty options chain shows that the maximum pain point is at 19550 and the put-call ratio (PCR) is at 0.88 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

“Years of practice at the game, of constant study, of always remembering, enable the trader to act on the instant when the unexpected happens as well as when the expected comes to pass.”

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 19390 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19556 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels for Finance Nifty

Buy Above 19585 Tgt 19610, 19646 and 19700 ( Finance Nifty Spot Levels)

Sell Below 19520 Tgt 19485, 19450 and 19423 (Finance Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.