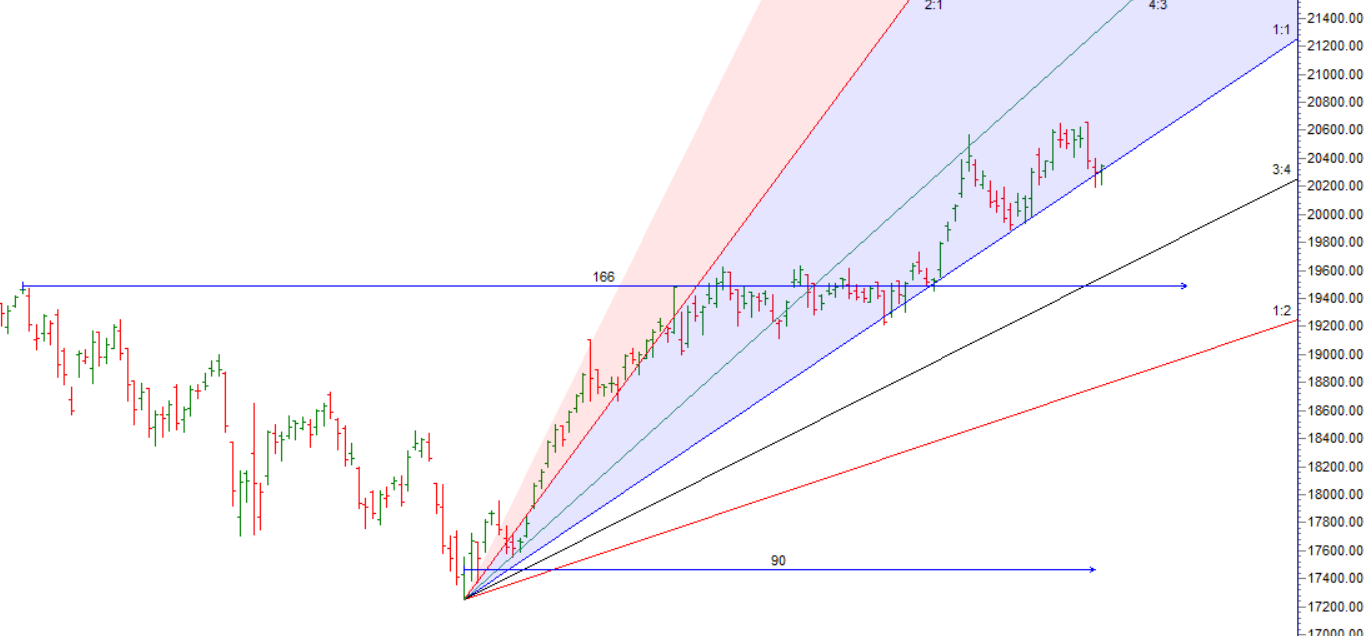

Finance Nifty has been trading in a sideways zone, which suggests that a trending move may be expected in the next two days based on the Full Moon and Mars Trine Jupiter Aspect as discussed in Below Video. For Intraday Traders tommrow first 15 mins HIgh and Low will guide for the day.

Finance Nifty Trade Plan Based on Inside Bar Bulls will get active above 20370 for a move towards 20438/20513/20588/20662. Bears will get active below 20200 for a move towards 20138/20063/19988/19913.

Traders may watch out for potential intraday reversals at 09:51,12:48,1:09,2:21,2:57 How to Find and Trade Intraday Reversal Times

Finance Nifty June Futures Open Interest Volume stood at 67040 with addition of 9080 contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Finance Nifty Advance Decline Ratio at 10:09, Finance Nifty Rollover Cost is @20638

Finance Nifty is back to its 20 SMA support.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20529-19953-19376 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 20529

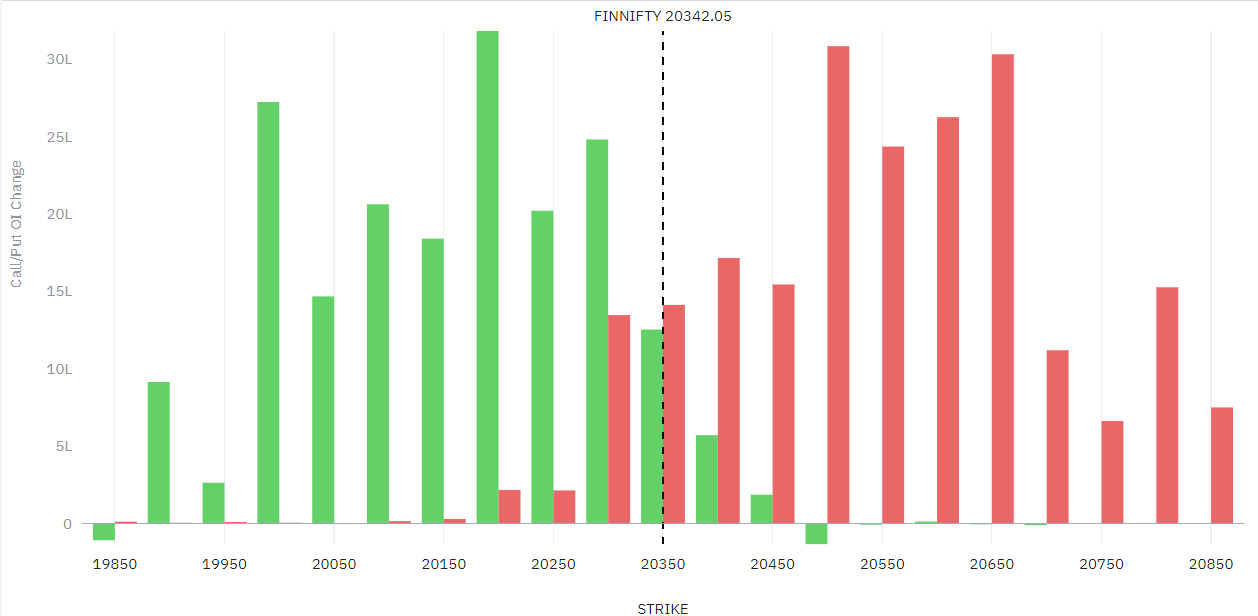

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 20400 strike, followed by the 20450 strike. On the put side, the 20300 strike has the highest OI, followed by the 20250 strike. Total Calls OI is 4.41 Cr and Total Put OI is 3.25 Cr This indicates that market participants anticipate Finance Nifty to stay within the 20450-20230 range.

The Finance Nifty options chain shows that the maximum pain point is at 20300 and the put-call ratio (PCR) is at 0.71. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Your goal every day is to improve. Each day is a gift from the market to improve. Work hard. Each day is an opportunity to get better. Focus on the process

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 20458 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 20402, Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels for Finance Nifty

Buy Above 20370 Tgt 20399, 20452 and 20500 (Fin Nifty Spot Levels)

Sell Below 20285 Tgt 20231, 20185 and 20120 (Fin Nifty Spot Levels)

Upper End of Expiry : 20452

Lower End of Expiry : 20231

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.