Price Movement

The price of MCX Crude closed at 6212 on July 14, 2023, up 2.14 % from the previous week’s close of 6082 . The week was marked by volatility, with the price ranging from a high of 6334 to a low of 6040.

Here are some factors that could influence crude oil prices in the week ahead:

- OPEC+ meeting: OPEC+ is scheduled to meet on 20 July to discuss production levels. Any changes to production levels could have a significant impact on crude oil prices.

- US economic data: The release of US economic data, such as the jobs report, could also influence crude oil prices.

- Geopolitical risks: Any geopolitical risks, such as an escalation of tensions in the Middle East/Russia Ukraine, could also support crude oil prices.

Overall, the outlook for crude oil prices in the week ahead is bullish. However, there are some risks that could weigh on prices. Traders should monitor these risks closely and adjust their trading strategies accordingly.

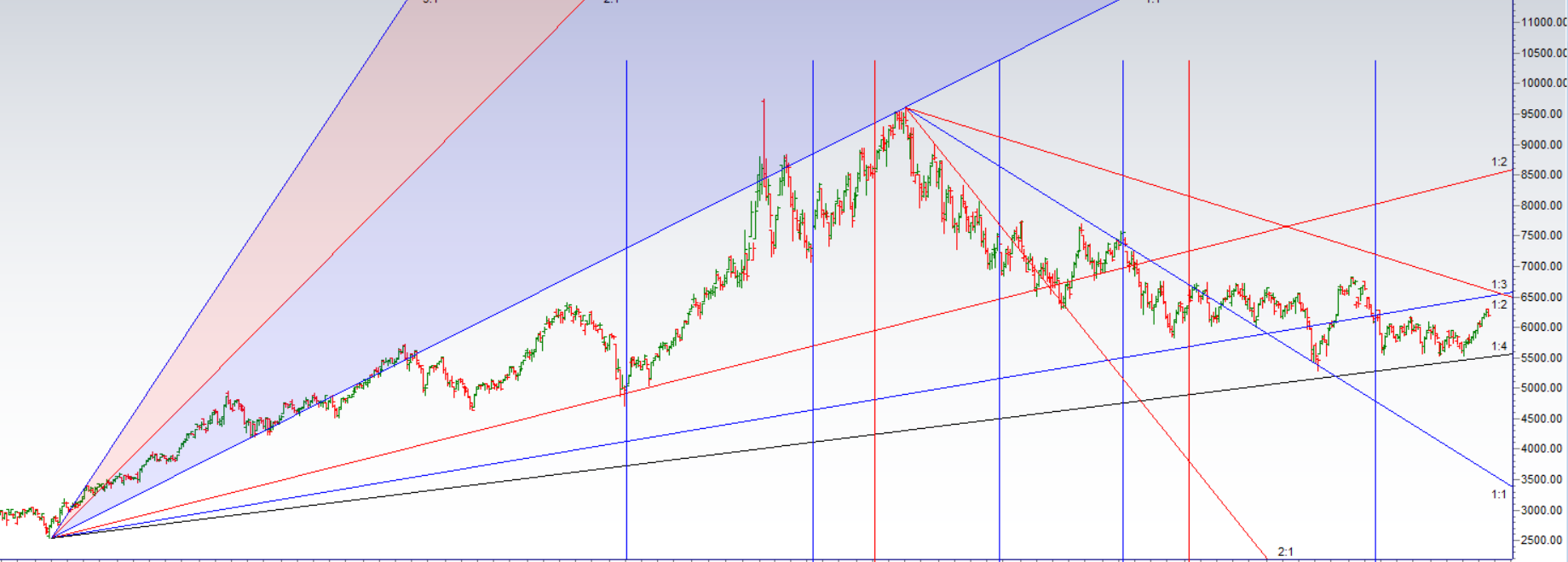

MCX Crude Oil Gann Angle Chart

Crude price showed strong revesal can lead to fall towards 6081/5920

MCX Crude Oil Astro Support and Resistace Line

Below 6166 Price can see fall towards 6066/5920

MCX Crude Oil Crude Harmonic

Price has taken resistance at 61.8%