The US Dollar is trading below 100, yet the USDINR pair has remained relatively stable despite the weak US Dollar. This stability is observed despite strong foreign portfolio investments (FPI) inflows into India. The Reserve Bank of India (RBI) is likely implementing aggressive intervention measures to maintain stability. The RBI may be buying US dollars in the forward and spot markets to prevent a sharp decline in USDINR. The RBI aims to minimize volatility in the Indian Rupee by purchasing USDINR when it weakens and selling when it strengthens. Thanks to the RBI’s intervention, USDINR has been trading within a contracting range for the past ten months. However, a continued fall in the US Dollar Index globally can increase pressure on USDINR to break down. If USDINR breaks below 81.50/60 on the spot, it may target the 80.00 levels. The zone near 81.50 is critical for maintaining the stability of USDINR.

USD INR Gann Angle Chart

USD INR Support can be found at 82 while resistance is observed at 83

USD INR Plannetary Support and Resistance Line

Indain Rupee is bounced from Venus Plannetary line heading towards 83/83.5

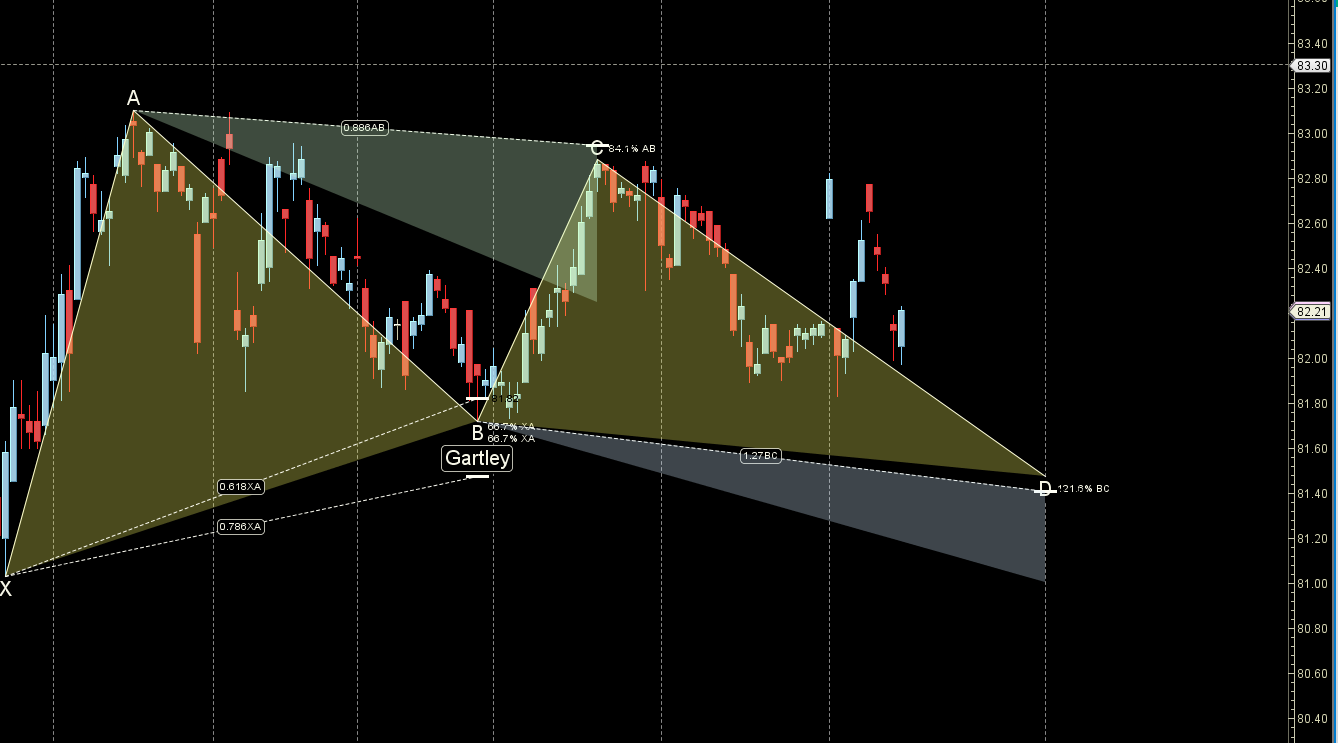

USD INR Harmonic

Price is heading towards 83