Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 3363 contracts worth 313 crores, resulting in a incease of 14077 contracts in the Net Open Interest. FIIs bought 5457 long contracts and added 9999 short contracts, indicating a preference for adding LONG and SHORT positions .With a Net FII Long Short ratio of 0.93 FIIs utilized the market fall to enter Long positions and enter short positions in NIFTY Futures.

As Discussed in Last Analysis Nifty did a breakout above Venus Ingress High of 05 JUne and saw a decent upmove. We have RBI Policy today try to trade after 10:30 AM when results on Intrest Rate are out, Yesterday Japan Market saw a correction of around 2% fall was swift and furious, Bull market correction are swift and fast, so keep your TSL in the system. Today we have Venus Square North Node aspect so expect decent volatality in the market.

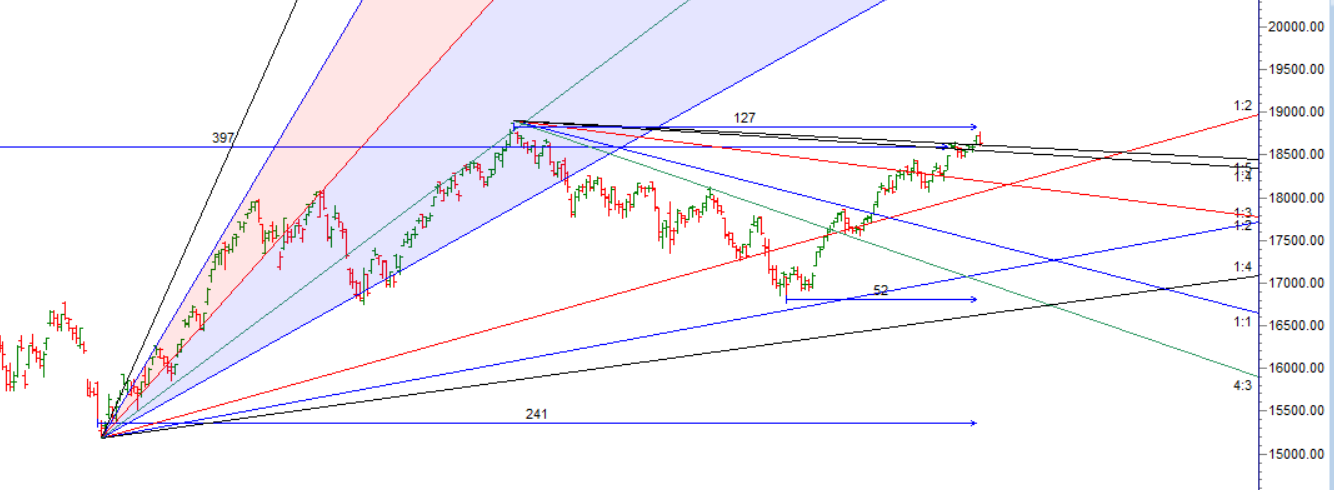

Venus Square North Node aspect showed its impact with nIfty seeing a small correction and price back to gann angle support and formed an OUTSIDE BAR Pattern.

The Outside Bar candlestick pattern is a popular chart pattern used in technical analysis. It consists of two consecutive candles, where the second candle completely engulfs the range of the preceding candle. Here are the key characteristics of the Outside Bar pattern:

- Bullish Outside Bar: In a bullish context, the first candle is a bearish candle, followed by a larger bullish candle that engulfs the entire range of the previous candle. This pattern suggests a potential reversal from bearish to bullish momentum.

- Bearish Outside Bar: In a bearish context, the first candle is a bullish candle, followed by a larger bearish candle that engulfs the entire range of the previous candle. This pattern indicates a possible reversal from bullish to bearish momentum.

The Outside Bar candlestick pattern is a popular chart pattern used in technical analysis. It consists of two consecutive candles, where the second candle completely engulfs the range of the preceding candle. Here are the key characteristics of the Outside Bar pattern:

- Bullish Outside Bar: In a bullish context, the first candle is a bearish candle, followed by a larger bullish candle that engulfs the entire range of the previous candle. This pattern suggests a potential reversal from bearish to bullish momentum.

- Bearish Outside Bar: In a bearish context, the first candle is a bullish candle, followed by a larger bearish candle that engulfs the entire range of the previous candle. This pattern indicates a possible reversal from bullish to bearish momentum.

The Outside Bar pattern is considered significant because it demonstrates a shift in market sentiment. It suggests that the buyers or sellers have gained control and can potentially lead to a continuation of the newly established trend. Traders often use this pattern as a signal to enter or exit trades, depending on the direction of the pattern and the overall market conditions.

However, it’s important to remember that candlestick patterns should not be used in isolation for trading decisions. It is advisable to consider other technical indicators, price action, and fundamental analysis to confirm the signals provided by the Outside Bar pattern before making any trading decisions.

Bayer Rule 2: Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes. Leads to Big Move watch for 15 mins High and Low to capture trend for the day.

For Swing Traders Bulls will get active above 18700 for a move towards 18777/18859 Bears will get active below 18610 for a move towards 18534/18453.

Traders may watch out for potential intraday reversals at 9:40,11:08,12:18,1:22 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 0.98 lakh, witnessing a addition of 3.6 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of LONG positions today.

Nifty Advance Decline Ratio at 12:38 and Nifty Rollover Cost is @18407 and Rollover is at 66.8%.

Major Support for Nifty us at 18431 @ 20 SMA

Nifty options chain shows that the maximum pain point is at 18700 and the put-call ratio (PCR) is at 0.83 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18600 strike, followed by 18700 strikes. On the put side, the highest OI is at the 18400 strike, followed by 18300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18500-18700 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 212 crores, while Domestic Institutional Investors (DII) sold 405 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price made high of 18777

Don’t overtrade. It’s tempting to trade frequently, but this can lead to losses. It’s better to trade less and focus on making high-quality trades.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18635 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18765 , Which Acts As An Intraday Trend Change Level.