Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 8451 contracts worth 792 crores, resulting in a incease of 20773 contracts in the Net Open Interest. FIIs bought 14333 long contracts and added 5754 short contracts, indicating a preference for adding LONG and SHORT positions .With a Net FII Long Short ratio of 0.850.98 FIIs utilized the market rise to enter Long positions and enter short positions in NIFTY Futures.

As Discussed in Last Analysis Nifty continue to be in Buy on Dips mode, whole day remain down but showed a smart recovery by end of the day forming a perfect DOJI, Nifty is waiting for RBI policy to provide fresh trigger. Mid and Small Caps are shhowing Decent move with many small caps hitting 20% UC, traction has shifted from Index to Small and Mid Cap Stocks.

Nifty did a breakout above Venus Ingress High of 05 JUne and saw a decent upmove. We have RBI Policy today try to trade after 10:30 AM when results on Intrest Rate are out, Yesterday Japan Market saw a correction of around 2% fall was swift and furious, Bull market correction are swift and fast, so keep your TSL in the system. Today we have Venus Square North Node aspect so expect decent volatality in the market.

For Swing Traders Bulls will get active above 18740 for a move towards 18804/18872 Bears will get active below 18666 for a move towards 18600/18532/18464.

Traders may watch out for potential intraday reversals at 9:43,10:44,12:22,1:26 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 0.95 lakh, witnessing a addition of 7.3 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of LONG positions today.

Nifty Advance Decline Ratio at 42:08 and Nifty Rollover Cost is @18407 and Rollover is at 66.8%.

Major Support for Nifty us at 18409 @ 20 SMA

According To Todays Data, Retailers Have bought 227 K Call Option Contracts And 263 K Call Option Contracts Were Shorted by them. Additionally, They bought 118 K Put Option Contracts And 11592 K Shorted Put Option Contracts were covered by them, Indicating A BEARISHOutlook.

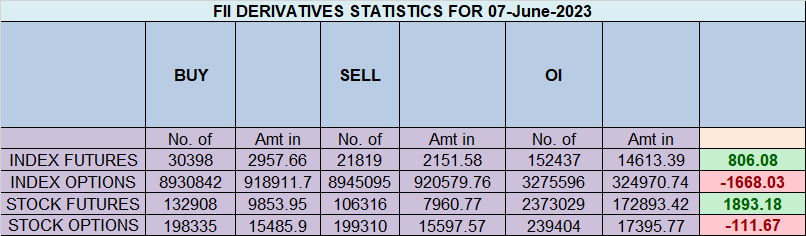

In Contrast, Foreign Institutional Investors (FIIs) bought 154 K Call Option Contracts And 115 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 174 K Put Option Contracts And 225 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To BULLISH Bias.

Nifty options chain shows that the maximum pain point is at 18700 and the put-call ratio (PCR) is at 0.97. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18600 strike, followed by 18700 strikes. On the put side, the highest OI is at the 18400 strike, followed by 18300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18500-18700 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 1382 crores, while Domestic Institutional Investors (DII) sold 392 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is coming near 18800

Don’t overtrade. It’s tempting to trade frequently, but this can lead to losses. It’s better to trade less and focus on making high-quality trades.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18622 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18762 , Which Acts As An Intraday Trend Change Level.