Again a side ways day price unable to sustain above 18200, Price Last expiry close was 18191 so we can see close around 1819 to form an expiry doji. Jupiter 40 Uranus both outer plannet so Bank Nifty should see firework. IT has already joined the party with bank support price can hit 50 SMA.

Jupiter 40 Uranus showed its effect Bank Nifty falling almost 1000 points in single trading session and Nifty also fell down 250+ . Very Few TRaders would have captured the move as most of them were not ready as Quatum of fall was Huge. The courage to act on such a knowledge will make the difference from an average trader to an outstanding one. You should look at the market at all times like a BULL and like a BEAR and this will keep you vigilant and allows you to book profits and reverse your trades or simply stay off the markets.

Tommrow we have “Bayer Rule 14: VENUS MOVEMENTS IN GEOCENTRIC LONGITUDE USING A UNIT OF 1*9’13”” and Venis Ingress which generally leads to top and Bottom formation

Nifty First 15 mins High and LOw will guide for the day.

NIfty hsas broken all its MA’s and now till above 18048 Bulls will be back.

MAX Pain is at 18100 PCR at 1.03 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 17 lakh contracts was seen at 18100 strike, which will act as a crucial resistance level and Maximum PUT open interest of 16 lakh contracts was seen at 17800 strike, which will act as a crucial Support level

Nifty Feb Future Open Interest Volume is at 0.98 Cr with addition of 33.9 Lakh with increase in Cost of Carry suggesting Long positions were closed today.

Nifty Rollover cost @18169and Rollover % @75 Closed below it.

FII’s sold 2393 cores and DII’s bought 1378 cores in cash segment.INR closed at 81.60

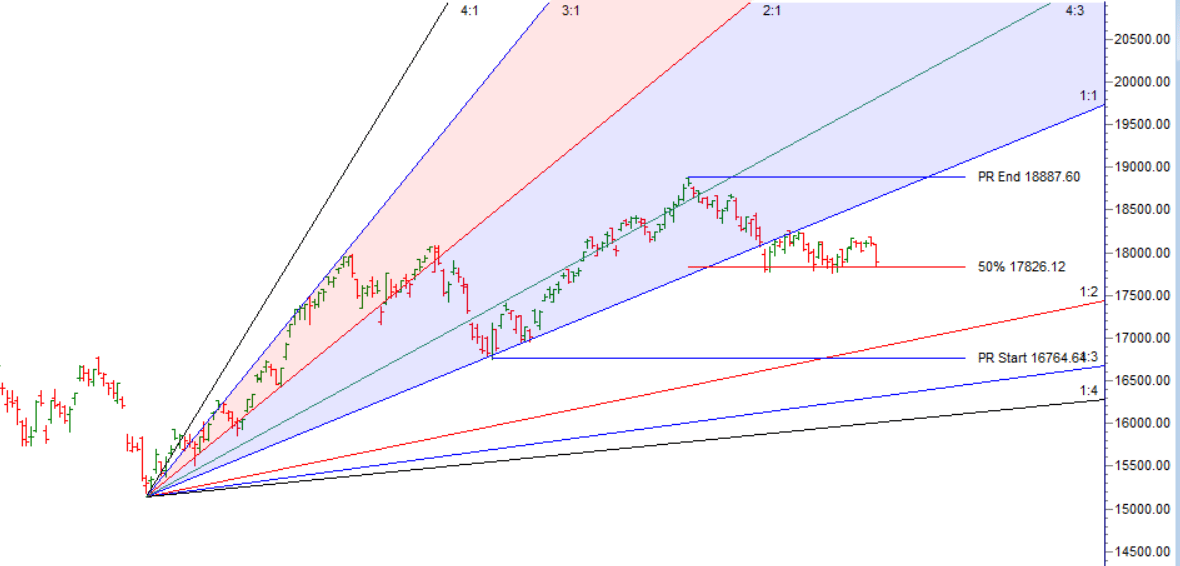

#NIFTY50 as per musical octave trading path can be 17799-18066-18336 take the side and ride the move !!

Review the last week’s entries in your trading journal. Count the number of positive, encouraging phrases in your writings and the number of negative, critical ones. If the ratio of positive to negative messages is less than one, you know you aren’t sustaining a healthy relationship with your inner coach. And if you’re not keeping a journal, your coach is silent. What sort of relationship is that?

Positional Traders Trend Change Level is 17934 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18024 will act as a Intraday Trend Change Level.